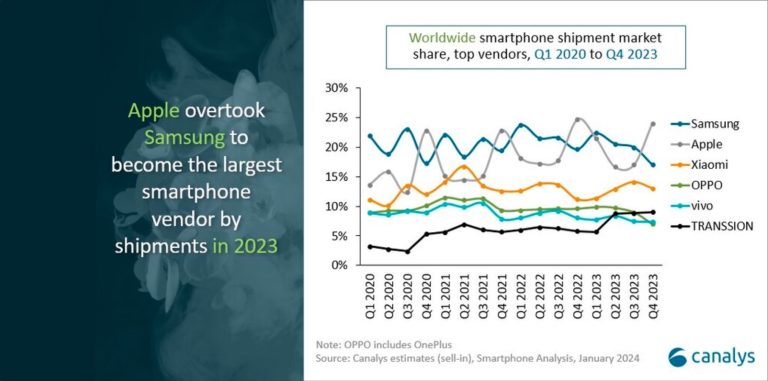

A change of strategy at Samsung headquarters made Apple and its iPhone the top-selling smartphone of 2023. At least, this is what research firm Canalys believes after revealing the preliminary numbers of smartphone shipments in Q4 2023.

According to the study, worldwide smartphone shipments grew 8% yearly in the fourth quarter of 2023, reaching 320 million units. With the first growth in seven consecutive quarters, Apple led the market with a 24% share of shipments thanks to the new iPhone 15 series.

On the other hand, Samsung took second place with 17%, followed by Xiaomi with over 20% growth, and Transsion in fourth place, benefiting from emerging market recovery. Canalys Research explained that Samsung’s new focus on the mid-end to high-end market paid a price, as it won profitability but lost share in the low-end segment:

“The top two players are eagerly looking for new growth drivers for their smartphone businesses as both suffered market share declines in Q4,” said Canalys Research Manager Amber Liu. “In 2023, Samsung focused on the mid-to-high-end segment for profitability but lost share in the low-end segment and also its leading position in the global market. Its 2024 product launches, especially in the high-end segment with a focus on on-device AI (see Canalys blog: “On-device AI and Samsung’s role in the future smart ecosystem race”), will support its rebound as an innovation leader in 2024.”

Apple, for example, has continued to drive solid demand in the high-end segment in the past two years. Despite the failure in the early sales of the iPhone 14 series, the new strategy for the iPhone 15 Pro Max with an exclusive feature and higher price point helped Apple be more profitable. Still, the company should worry about Huawei in China.

“Apple showed resilience over the past two years, thanks to solid ongoing demand in the high-end segment. The expanded positioning of its iPhone 15 series has pointed to the future direction of Apple’s portfolio strategy to reach a broader range of consumer segments,” said Liu. “But Huawei’s improving strength and looming local competition in mainland China will challenge Apple to sustain its growth trajectory in mainland China while high-end replacement demand in other major markets, such as North America and Europe, is leveling off. Apple must look to new market growth and ecosystem strength to reinvigorate its iPhone business.”