Last week, the results of a hugely important Federal Communications Commission auction came out. The Commission was selling the rights to use re-purposed TV spectrum to wireless carriers, and T-Mobile spent $8 billion to buy far more spectrum than anyone else.

The spectrum being auctioned is particularly valuable low-band airwaves that work better in rural areas and indoors — two areas that T-Mobile has struggled with, compared to Verizon, which has long held the licenses to a large amount of low-band spectrum.

But a new analysis of the data shows that while T-Mobile might have spent far more than any other company in the auction, it wasn’t just a case of having a bigger purse. Spectrum was sold in seven 10MHz bands, and each band was available for a particular region. For example, T-Mobile could have bought Band G for use in Washington DC, but AT&T could have bought the rights to the same band in New York City.

Overall, T-Mobile spent nearly $8 billion to buy 1,525 licenses. AT&T spent just $910 million, but only acquired 23 licenses. As Fierce Wireless pointed out, that brings AT&T’s per-license spend to nearly $40 million, while T-Mobile spent just $5.2 million per license.

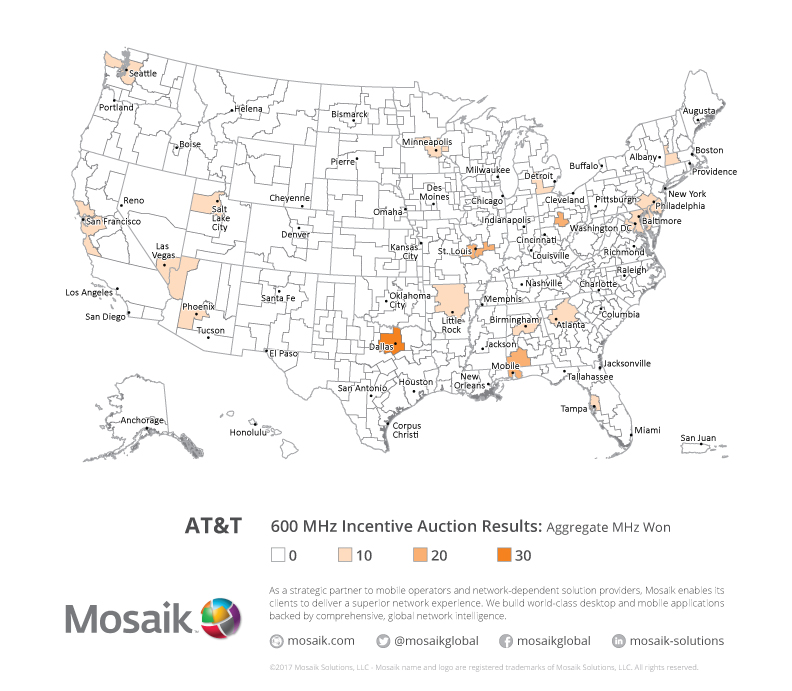

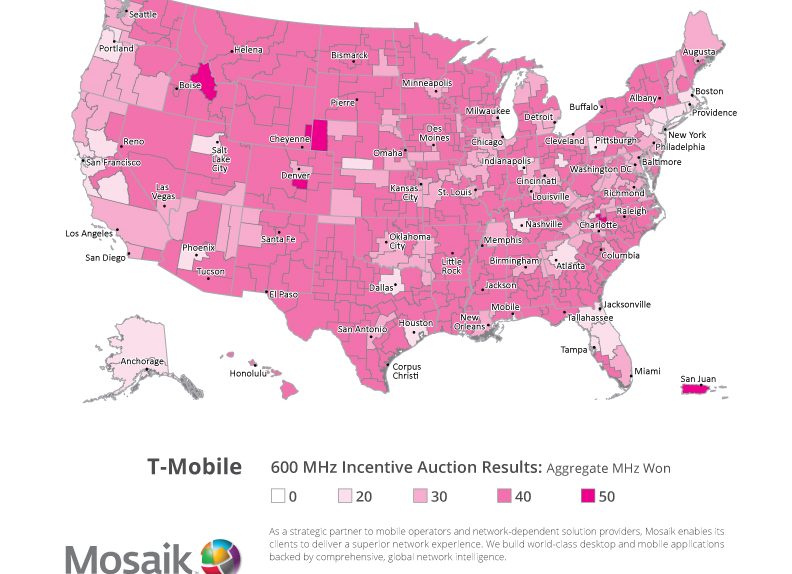

A lot of that difference is probably down to geography. As you can see from the maps from Mosaik included below, T-Mobile bought spectrum in every single market across the country, including a lot of rural areas that were less valuable. AT&T focused its spectrum buys around much more expensive areas, like the Philadelphia-DC metro area, Dallas, Seattle, and San Francisco.

Looking at the raw auction data from the FCC, this becomes even more clear. T-Mobile and AT&T paid exactly the same price in regions like New York, Chicago and San Francisco; the difference is that AT&T didn’t even bid on spectrum in Wahpeton, ND, where licenses were sold for $5,000.

But on a strategic level, it’s still likely that history will show T-Mobile as the big winner from this auction. AT&T only invested in spectrum in urban areas where it already owns bandwidth, seeing it as a short-term way to alleviate network congestion. But in cities, spectrum is less likely to be a big deal in 20 years: solutions like LTE-U and Wi-Fi hotspots, deployed every couple hundred meters and inside buildings, are going to be the only way to handle overwhelming growth in the number of internet-connected devices.

So, AT&T paid through the nose for a short-term fix to network problems. T-Mobile, on the other hand, bought up new spectrum nationwide, in many cases in regions that are under-populated, and bought most of that spectrum for dirt-cheap. Just think about how Verizon is able to be competitive these days: it can charge a higher price for a network that’s only superior because of spectrum licenses it bought decades ago. In 20 years, AT&T might find itself ruing the day it decided Wahpeton, ND wasn’t worth $5,000.