It’s another crypto bloodbath, Bitcoin fans. Very early on Friday, prices started dropping more than usual. It all seemed like just another regular start of the day. Bitcoin and the entire market have been on a continued downward trend for weeks, as the bears are still in control of the action.

It soon became clear that this wasn’t just another Friday. Bitcoin lost nearly $700, trading as low as $6,100 on some exchanges. And when Bitcoin drops, everything else follows.

As of the time of this writing, all coins are plummeting and there’s no clear explanation as to what’s causing the new lows. Because yes, Bitcoin has reached a new low, trading for as much as $500 below the $6,600 price it hit back in March. At the time, that was the lowest price for the popular cryptocurrency since it climbed to all-time highs late last year.

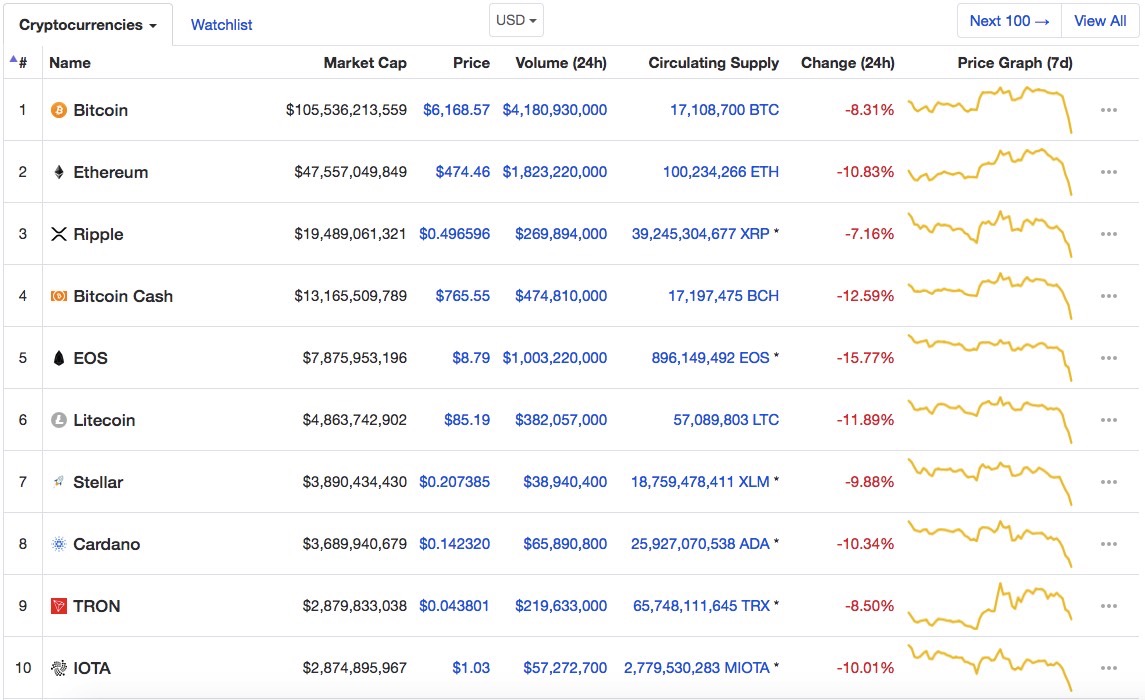

Ethereum, Ripple, Bitcoin Cash, and EOS are all following Bitcoin’s lead, trading anywhere from 7% to 15% lower than yesterday at the time of this writing. Here’s how things are looking:

The entire crypto market lost more than $20 billion in value in a single day. Market cap alone doesn’t tell the whole story, but it does show how incredibly fickle cryptocoins are. Bitcoin and the entire market could rebound just as fast. That’s how Bitcoin trading works. The overall sentiment towards Bitcoin appears to be negative, however, and there’s no telling how long it’ll take until we see a sustained trend upwards.

Earlier this week, South Korean crypto exchange Bithumb reported a theft of around $30 million, which was the second crypto hack in a matter of weeks. However, that news did not seem to impact the price of Bitcoin as much as we’d have expected.

More recent events may have contributed to Bitcoin’s new crash. The Japan financial regulator Financial Services Agency (FSA) sent business improvements orders to six major crypto exchanges, per CoinTelegraph, including bitFlyer, Quoine, BTC Box, Bit Bank, Tech Bureau and Bit Point.

The FSA wants exchanges to identify their customers and take measures against money laundering schemes. In response, bitFlyer has already begun taking steps to address the concerns. One of the first orders of business was to stop new account registrations.

In China, meanwhile, authorities have seized 200 Bitcoin and Ethereum mining rigs, CCNreports, with a suspect having apparently having stolen 150,000 kW hours of electricity in just over a month. This isn’t as impactful as the FSA’s requirement, but it still shows that China is very much paying attention to what’s happening in the crypto space.