The Bitcoin bloodbath of early February, the second and biggest such event of the year, seems to be forgotten. After plunging through $10,000 and dropping below $6,000 on bad regulation news from Asia, Bitcoin recovered plenty of ground in the past few days, trading for as high as $9,000 across exchanges — one Bitcoin costs just over $8,700 at the time of this writing.

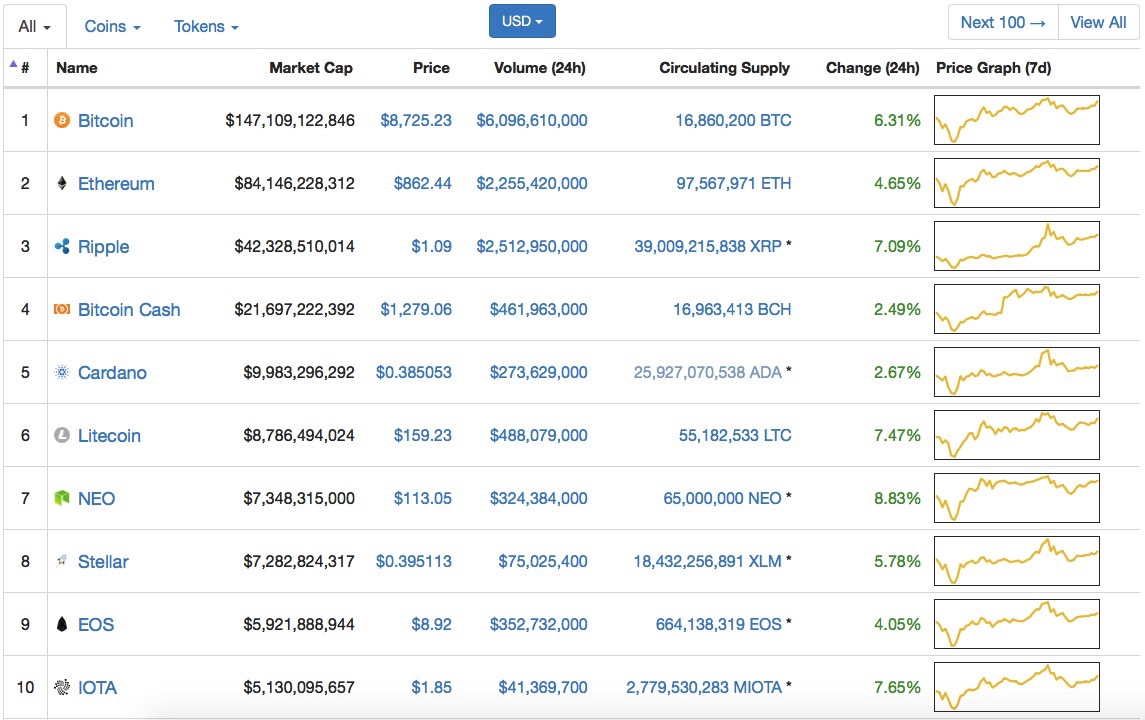

It’s good news across the board, as all cryptocurrencies are doing well in early trading. We’re looking at single-digit gains for most of them — ranging from 2.49% (Bitcoin Cash) to 8.83% (Neo) when looking only at the top 10 coins by market share.

So what’s happening?

It seems like the market is settling in for what may turn out to be another period of growth. That’s because we’re currently looking at mixed news related to cryptocurrency from around the world. But the panic seems to be over for the most part.

In Europe, for example, German and French officials including Bruno Le Maire, France’s Minister of the Economy; Peter Altmaier, acting German Finance Minister; Francois Villeroy De Galhau, governor of the Bank of France; and Jens Weidmann, president of the Deutsche Bundesbank, are urging the G20 to take action regarding cryptocurrency. Per CCN, the officials inked a letter demanding that the matter is discussed at the Buenos Aires G20 meeting on March 19-20.

Also in Europe, Reuters reports, Gibraltar wants to introduce the “world’s first” ICO regulation. That countries will want to regulate initial coin offerings shouldn’t be surprising, given that the recent pro-exchange regulation wave that swept off Asia.

But there’s plenty of good news from the region as well. Iceland is considering a Bitcoin mining tax, NewsBTC explains, given that the country’s climate and access to renewable energy sources are very attractive to mining businesses. The same site explains that while big banks aren’t too keen on helping customers trade Bitcoin and other digital currencies, smaller commercial banks in Germany, Liechtenstein, and Switzerland, welcome this particular type of business.

In the US, meanwhile, a JPMorgan internal report practically confirmed that cryptocurrencies aren’t going anywhere anytime soon and that you can’t have blockchain technology, without cryptos:

https://twitter.com/iamjosephyoung/status/962345396600160256

The US Senate is also looking at cryptocurrency but from a different point of view: the terror threat. According to CCN, the US Senate held hearings on amending the Department of Homeland Security Authorization Act via HB2825. One section of the bill contained language similar to HR2433, a bill introduced last May calling for the DHS and other intelligence agencies to whether digital coins can be used to finance terrorist groups.

A different Senate, Arizona’s is getting ready to allow residents to pay their taxes with cryptocurrencies, CoinTelegraph reports.

There’s more talk about regulation from Abu Dhabi, where the local financial regulator is considering embracing regulations for the cryptocurrency industry, per CCN.

Finally, NewsBTC notes that Japan remains optimistic about the future of crypto coins in spite of the recent bloodbath caused by tighter regulations, and the $530 million heist a Tokyo-based exchange suffered a few weeks ago. The Japanese government apparently believes that it can take the lead in the regional cryptocurrency race.

Speaking of hackers targeting crypto exchanges, CCN explains that cyberinsurance providers are eying cryptocurrency exchanges. Ultimately, that may turn out to be great news for consumers.