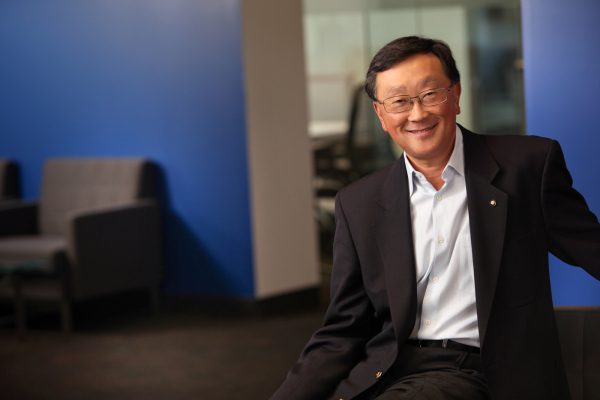

Something very curious happened late last week: BlackBerry posted worse-than-expected quarterly earnings and yet its stock soared following the news. Why, you ask? In part because the stock had almost nowhere to go but up since a valuation in the low $6-per-share range gave the company a market cap worth significantly less than the worth of its total assets. However, there was another crucial reason for the surge in BlackBerry shares: New CEO John Chen apparently gave investors fresh confidence that he had something resembling a plan to stabilize the company’s finances and prevent it from plunging completely into oblivion.

Barron’s flags a few notes from analysts who give Chen an early thumbs-up for his plan to abandon the high-end consumer smartphone market and refocus the company’s efforts on building enterprise-centric devices, software and services. Evercore Partners analyst Mark McKechnie, for one, said that Chen’s plan means that BlackBerry “now has a rudder” since it won’t be trying to compete in the high-end consumer market with the likes of Apple and Samsung and will be able to focus its talent and resources on enterprise solutions.

MKM Partners analyst Michael Genovese, meanwhile, said that he appreciated Chen’s “frank talk” during the company’s earnings call and said that “new management sounds better than old management,” which is faint praise considering that old management drove the company right into the ground. Nonetheless, Genovese is bearish on the company’s decision to keep producing hardware, even if it’s outsourced most of the work to Foxconn and even if the vast majority of the new hardware will be low-end devices targeting emerging markets.

All the same, given the dilapidated state BlackBerry finds itself in, it will take vague and cautious hope over the proclamations of doom that have followed the company for the past several months and that had driven its share prices to the lowest they’d been in more than a decade.