Tax season can be incredibly complicated for owners of cryptocurrencies like bitcoin. You need to figure out if you’ve been profitable or whether you’ve incurred losses so that you can file your taxes appropriately. Cryptocurrency exchange Coinbase wants to make the entire process a lot easier. After announcing features that would make cryptocurrency tax filing easier, Coinbase now says you can receive your tax refund directly to your account. And you can choose to have it converted automatically to bitcoin or the cryptocurrency of your choice.

Filing cryptocurrency taxes

Coinbase announced a few days ago that it would make it easier for customers to make sense of their cryptocurrency taxes. The exchange is introducing a tax center that should provide all the information you need to file your taxes, at least when it comes to the crypto transactions you’ve conducted on Coinbase.

The tax center will provide you with all of the taxable activity on Coinbase and tell you if you owe taxes and how much you have to pay.

The service will also help out with transactions outside of Coinbase. If you’ve moved cryptocurrency to and from Coinbase Pro, you can get free tax reports of up to 3,000 transactions. Coinbase partnered with CoinTracker for this feature.

An accountant can then use the cryptocurrency tax information that Coinbase provides. Or Coinbase customers who file their own taxes can use the data in tax software like TurboTax. That’s an important detail that will come in handy later for processing tax refunds directly to your Coinbase account.

On that note, Coinbase offers customers up to $20 off TurboTax products. Similarly, you get 10% off CoinTracker, if you need to manage cryptocurrency transactions that happened outside of Coinbase.

To get to the new tax center, all you have to do is log into Coinbase, tap your profile in the upper right corner, and select the new Taxes menu.

Get your refund in your Coinbase account

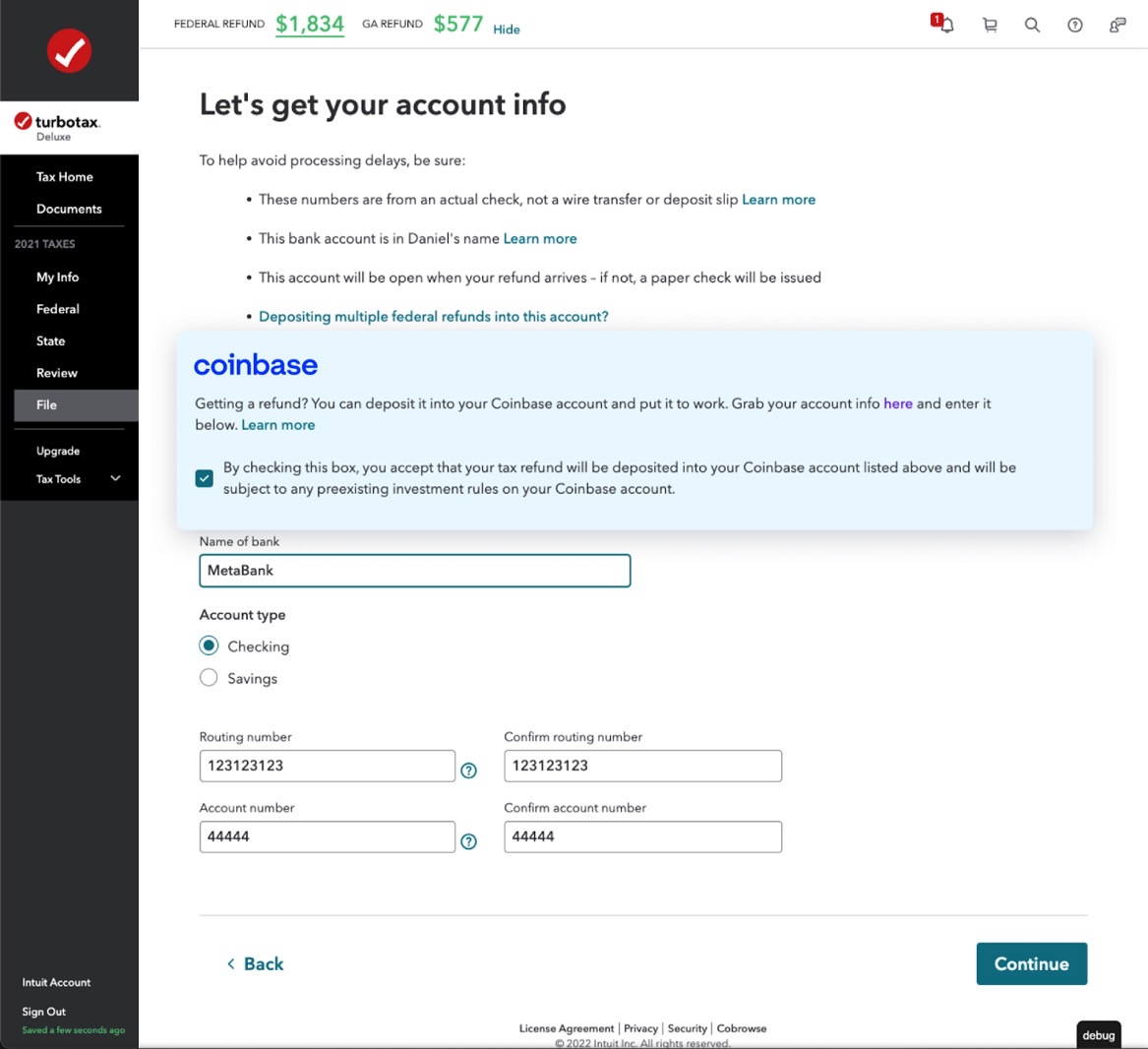

All of that brings us to Coinbase’s Friday announcement concerning tax refunds. The exchange says it will let customers get their tax refunds deposited automatically into Coinbase. The money will arrive as a USD deposit. But users can opt to have Coinbase exchange it for their favorite crypto automatically when the tax refund arrives.

To take advantage of the functionality, you’ll have to file your taxes with TurboTax. That’s why the TurboTax deal mentioned above might make the most sense if you plan on using Coinbase’s cryptocurrency tax tools.

You’ll have to start filing your taxes from the Coinbase section of the TurboTax website. Once the tax refund is calculated, TurboTax will ask you to enter account details for the refund. You can select the Coinbase option from there, at which point Coinbase will let you activate a direct deposit account.

You’ll be able to choose whether to receive the tax refund in US dollars or have it converted into your favorite cryptocurrency. Coinbase will provide the service free of charge, regardless of the option you choose.

To start filing your cryptocurrency taxes with Coinbase, visit this link. Follow this Coinbase tutorial to have your tax refund sent to your Coinbase account.