- Bitcoin’s price flash-crashed from nearly $8,000 to about $5,650 in early Thursday trading, taking the entire cryptocurrency market along for the ride.

- The sudden dip can easily be correlated with the panic on Wall Street, where the Dow futures took a massive 1,100 points dip early on Thursday over coronavirus pandemic concerns.

- The COVID-19 pandemic and the oil price war might not be the only reasons Bitcoin’s price fell so sharply this week. Foul play from bitcoin whales is also suspected.

- Visit BGR’s homepage for more stories.

The coronavirus outbreak seems out of control in some regions, with the World Health Organization having declared it a pandemic on Wednesday afternoon. Italy is on lockdown, as the local government is trying to reduce the number of infections and deaths at all costs. The number of cases in Italy surged from just a few to more than 12,000 in less than three weeks, and there are worries that other countries might follow the same trend. Similar measures might be required in other regions to prevent the potential collapse of local medical systems that are trying to keep those infected alive.

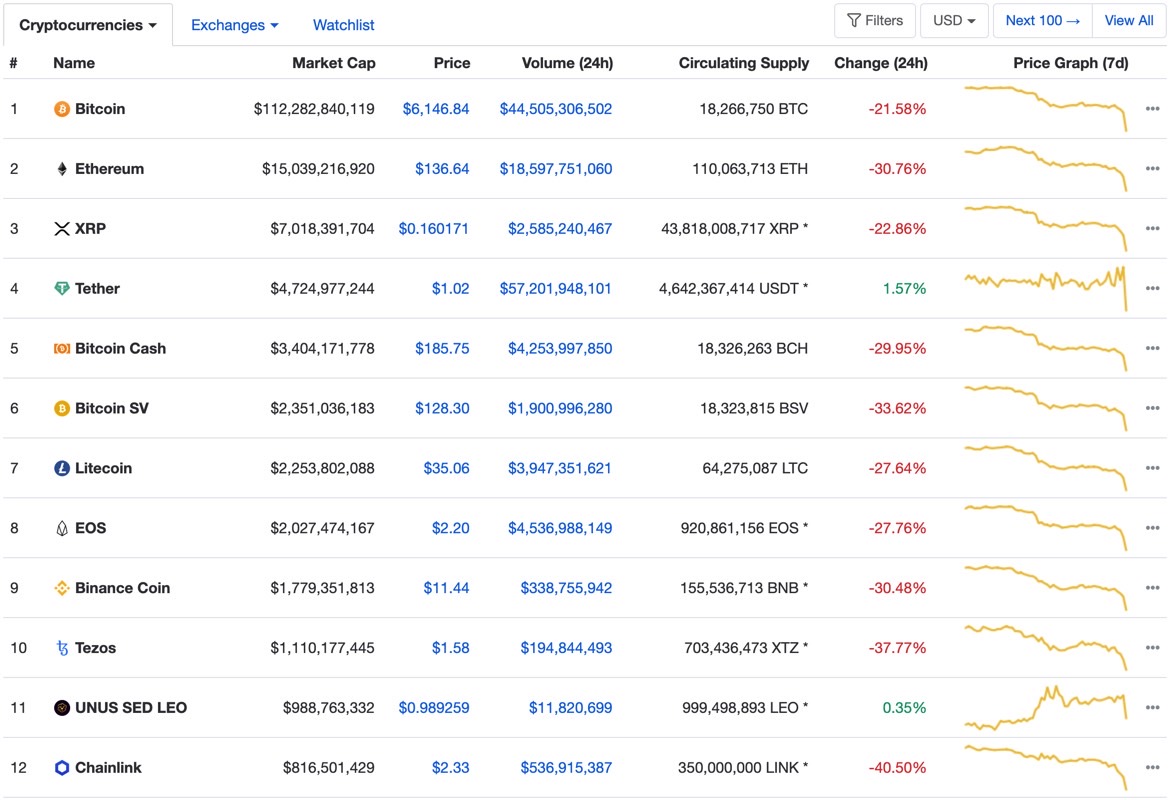

The worldwide economy is expected to take a huge hit, and that’s not actually news. Since the first weeks of the COVID-19 infections, there was talk of an imminent global recession caused by China’s lockdown. But now that the virus has engulfed Western countries including all of Europe and the US, investors have been in panic mode for the last few weeks. Dow futures just dropped 1,100 points following Donald Trump’s speech on Wednesday, and that’s not the only financial indicator that proves investors aren’t happy. The entire crypto ecosystem took a massive hit early on Thursday, with bitcoin trading down nearly 25% at the time of this writing. Bitcoin dropped as low as $5650 per bitcoin, a figure not seen since last May. The coronavirus panic might not be the only thing affecting the price of the world’s most prized cryptocurrency, however.

The coronavirus pandemic isn’t the only factor that might be hurting the crypto ecosystem right now, although many might think the virus scare is to blame for the massive sell-off. Bitcoin was trading above $10,000 just a couple of weeks ago, with some expecting at the time to see even higher gains. But the first major drop occurred a few days ago and was associated with the OPEC-Russia oil war that sent oil markets into a frenzy.

According to Forbes, the coronavirus scare that prompted the huge stock plunge in the US and other markets and the oil crisis are just two reasons that can explain the massive bitcoin price drop. There might be another thing at play here, an activity that’s hidden by this perfect storm. Bitcoin whales, or individuals who hold large amounts of digital currency who can manipulate the price by placing large buy or sell orders, may have accelerated the depreciation of the world’s most recognized cryptocurrency.

“The sudden drop in prices seems to arise out of the selling of BTC by PlusToken,” CoinSwitch.co CEO Ashish Singhal told CoinDesk.

PlusToken is a Ponzi scheme that swept China and Korea in the past few years, with some $2 billion worth of digital assets having been stolen from investors. PlusToken scammers apparently started moving more than $100 million worth of bitcoin last Saturday ahead of the OPEC news, with the help of accounts meant to disguise the origin and destination of the coins. By flooding the market with bitcoin supply, the fraudsters were able to shed almost $1,000 of bitcoin’s value at the time, with the coin dipping below $7,925. Bitcoin hasn’t been able to top $10,000 since, and early on Thursday, it fell sharply below $6,000.

The same PlusToken fraudsters are believed to have been responsible for bitcoin’s downfall last year when the price dropped from $12,000 to $6,500 over a four-month period ending in November.

If all this is accurate, then the scammers were able to take advantage of the perfect cover for this new hit on bitcoin. After all, considering what’s happening on stock exchanges around the world because of the COVID-19 pandemic, as well as the brand new oil war, it’s easy to assume that some investors pulled out of crypto to cover losses elsewhere.

Bitcoin is not the only crypto coin affected by these massive sell-offs, as all other major digital coins are showing losses of between 20% and 40% at the time of this writing.