We’re three for three when it comes to substantial Bitcoin crashes. After the slumps of January and February, the first significant Bitcoin price crash has just arrived, taking the price well below that magical $10,000 mark that makes many people feel safe for the sixth time this year.

There’s nothing special about that price point, and just because Bitcoin is trading at significantly lower levels than Thursday, it doesn’t mean the market won’t recover at some point soon. The same thing happened after in the two previous bloodbaths. Bitcoin may have no reached its mid-December heights, but it was able to get back above $10,000 every time.

So what happened?

It all started a few days ago when the Securities and Exchange Commission (SEC) announced that crypto exchanges will have to obey the same rules as everyone else.

Right about the same time, some Binance traders were spooked, as they discovered that someone had traded their altcoins away. Binance stopped withdrawals and investigated the matter, concluding that some people may have been hacked via phishing schemes, and that’s how attackers were able to mess with their accounts — though they were not able to steal any cryptos or money, the company said.

If that’s not enough, it was discovered that Mt Gox trustees have been selling massive amounts of Bitcoin to raise funds to pay the creditors of what used to be the largest Bitcoin exchange in the world before being hit by a huge hack that eventually led to its demise.

Per Bloomberg, Mt Gox’s Tokyo attorney and bankruptcy trustee said in a creditor’s meeting this week that he has sold $400 million of the company’s Bitcoin since September. Nobuaki Kobayashi is in control of a pool of more than 166,000 Bitcoins as of March 5th. By flooding the market with Bitcoin, some traders believe, he may have contributed to Bitcoin’s crash in February.

Combined, all these bad news are wreaking havoc right now in the crypto world.

“Our take on this is that the new investors in the space don’t have enough time to analyze what’s happening,” London Block Exchange analysts said in a report on Friday, according to Business Insider.

“The amount of fake or misleading information reported over the past few days, as discussed in yesterday’s report, made the ‘regulation meets Mt. Gox dump and Binance pump’ narrative far too scary. So much so, in fact, that even the more dedicated (but less sophisticated) traders believe it.”

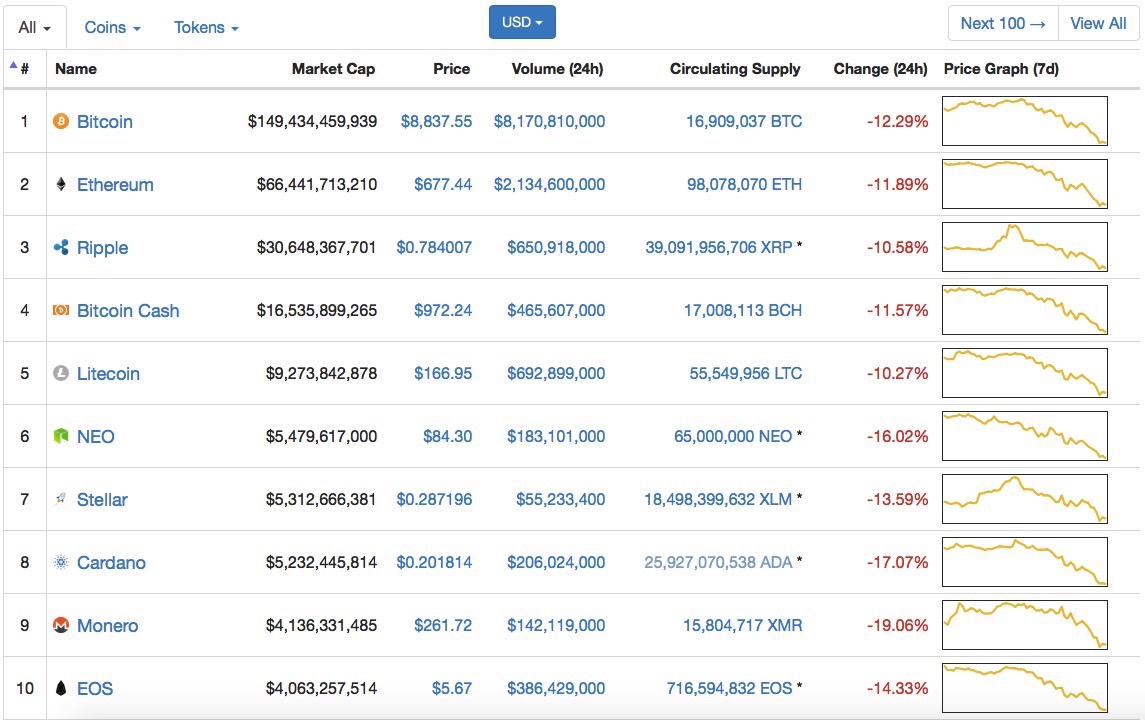

The top 10 coins are down anywhere from 10% (Litecoin) to 20% (Moneoro). Trading at around $8,800, Bitcoin is down more than 12% for the day.