All digital coins rallied over the weekend, with Bitcoin testing the $9,000 price. On Monday, things were looking up for all cryptocurrencies, as Bitcoin tested the $9,000 mark again by evening. But the most famous digital money in the world failed to break through it and move towards that $10,000 threshold. Currently, it’s ranging at around $8,500, which isn’t bad news, but it’s not great either.

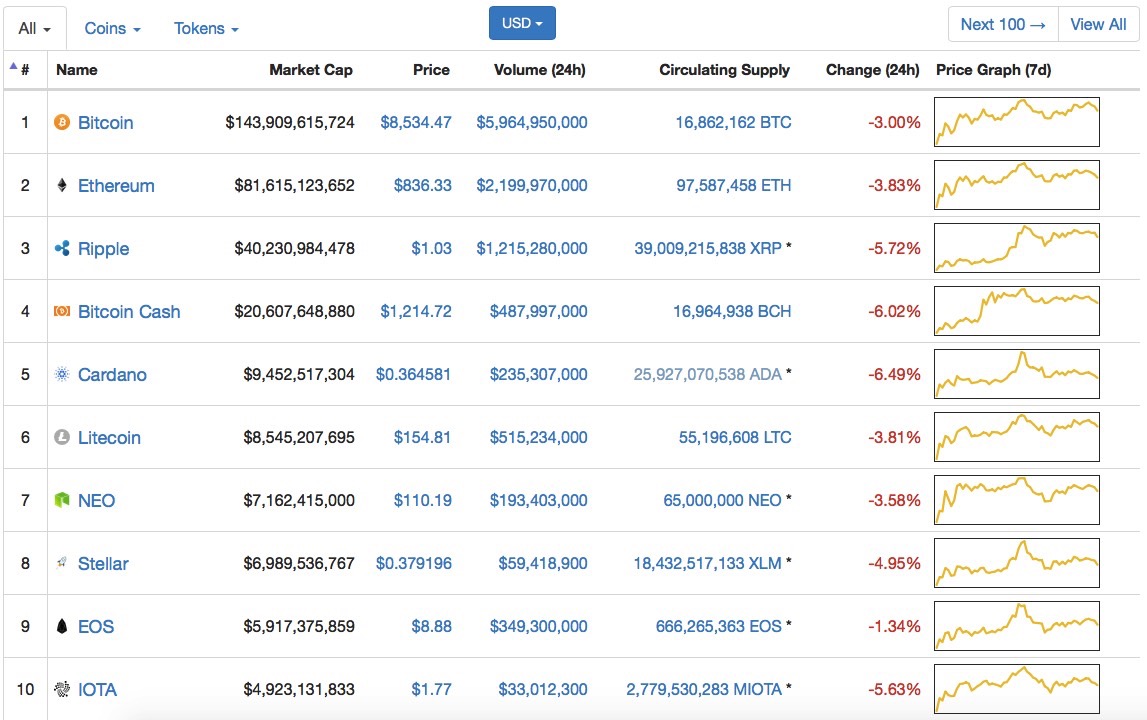

The top 10 coins by market cap are all down by up to 6% in 24-hour trading. So what’s happening in the crypto world?

On Monday we saw a bunch of positive and negative news for Bitcoin, which failed to alter the current sentiment of the market. The early February panic, when Bitcoin plunged through $10,000 for the third time this year, stopping below $6,000, which was a first since November, seems to be gone.

The crackdown on Bitcoin continues, however, with Fortune reporting that the New Jersey Bureau of Securities ordered Bitcoin investment pool Bitstrade to stop offering its good in the state. The state says the company had been offering the equivalent of securities to customers without registering with the local government.

JPMorgan, meanwhile, believes that conditions may be forming for a sell-off at around $4,605, according to Business Insider .”The question is whether we go there straight away, indicated on a failure to clear $10,128 and $10,776, or at a later stage after a stronger countertrend rally,” technical analysts said in a research note on Friday. But the bank also said that should Bitcoin move past $10,776, “the door for a broader countertrend rally to $14,334 if not to $16,304 (76.4% on different scales) would be wide open.”

On a more positive note, Microsoft on Monday announced that it’ll support decentralized identities systems built on Bitcoin and other blockchains, which shows, again, the potential of the blockchain technology, and why companies are so interested in it.

With a decentralized identity system, a person could manage his or her entire online identity without the worry of it being censored or abused in any way by a central authority. Decentralized IDs (DID), Microsoft explains, would improve privacy and might reduce the risk of data breaches and identity theft. Furthermore, DIDs could still offer users personalized experiences across apps and services. Microsoft specifically mentions the blockchains used by Bitcoin, Ethereum, and Litecoin as models for future DIDs.

That said, there’s no telling where Bitcoin price may move next, but cryptocurrencies are far from doom, even though they may still be in a bubble of their own. What’s certain is that wherever Bitcoin goes, all the altcoins will follow its lead.