After falling below $10,000 again last week, Bitcoin dipped under $9,000 on Tuesday as all digital coins continue to lose value. We’re not looking at a “bloodbath” similar to what happened in February, but no coin out there is safe. Fear of regulations still loom, although not all the news is bad right now.

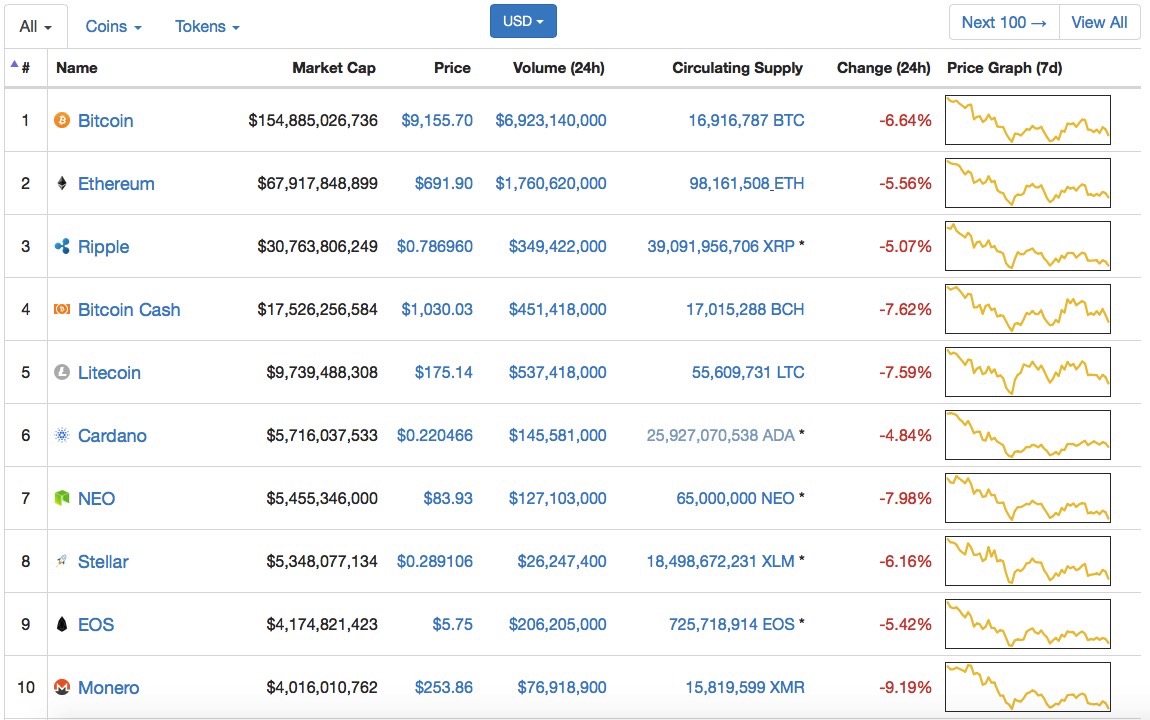

At the time of this writing, Bitcoin was trading almost 7% below Monday’s price, while all of the top 10 coins showed similar performance. Ethereum and Ripple prices declined by 5%, while Bitcoin Cash and Litecoin dropped by almost 8%. Let’s see what’s happening in the world of cryptocurrencies today.

Goldman Sachs said in a research note that Bitcoin may drop even lower than February’s $6,000 price, which was the first time Bitcoin hit that level since last November. This time, however, Bitcoin was declining whereas in November it was racing to record highs.

Japan has been urging the G20 to introduce unified crypto regulation meant to prevent money laundering schemes and protect customers. Thailand’s SEC is also looking to introduce crypto market regulation framework this month.

China, meanwhile, is working on working on its own development of blockchain technology even though it’s one of the major Bitcoin markets out there that has taken regulatory steps with crypto trading. Good news comes from South Korean regulators, who have changed their minds about ICOs. Initial Coin Offerings may soon become available in the country again, although they would be regulated this time around.

In a public letter, Dutch Minister of Finance Wopke Hoekstra is also asking for a multi-national approach to crypto regulation, although he acknowledges that regulation will take time to develop. The European Commission has great news for miners, however. There’s no legal basis to block cryptocurrency mining, in spite of recent worries about rising electricity consumption caused by miners.

Finally, the Bank for International Settlements said in a report on Monday that central banks would threaten the global financial system if they issued their own cryptocurrencies. Various banks out there are already testing out different blockchain technologies that would allow users to transfer money easier, faster, and cheaper than before. But most of these banks are using technology provided by Bitcoin rivals that developed alternative blockchain tech and tokens that are currently trading on exchanges right alongside Bitcoin.