Around this time four years ago, Goldman Sachs CEO David Solomon was raving during a conference call with investors that his firm’s partnership with Apple had resulted in the “most successful credit card launch ever.” Commenting on the iPhone maker’s debut of the Apple Card, backed by the banking infrastructure made possible by Goldman Sachs, Solomon went on to tout everything from strong customer demand for the new card to smooth customer “inflows” without the firm “compromising our credit underwriting standards.”

But that was then. Today, Goldman and Apple can’t seem to end their partnership fast enough. Despite having extended their Apple Card pact last year through 2029, Goldman has reportedly been trying to exit the arrangement after losing billions of dollars — moreover, Apple has now sent Goldman a proposal that would allow both companies to go their separate ways next year. Talk about a corporate romance that crashed and burned.

We can hash out theories over what went wrong, starting with the fact that Goldman Sachs probably wasn’t the right partner for Apple to begin with. But there’s something even more fundamental, I think, that’s gotten a little overlooked in this turn of events — specifically, amid the Apple-Goldman news coverage over the past 24 hours: It’s that Apple Card remains a fantastic, easy-to-use product, especially for security-conscious consumers like me, with several features that the card industry as a whole ought to copy (even though it absolutely won’t).

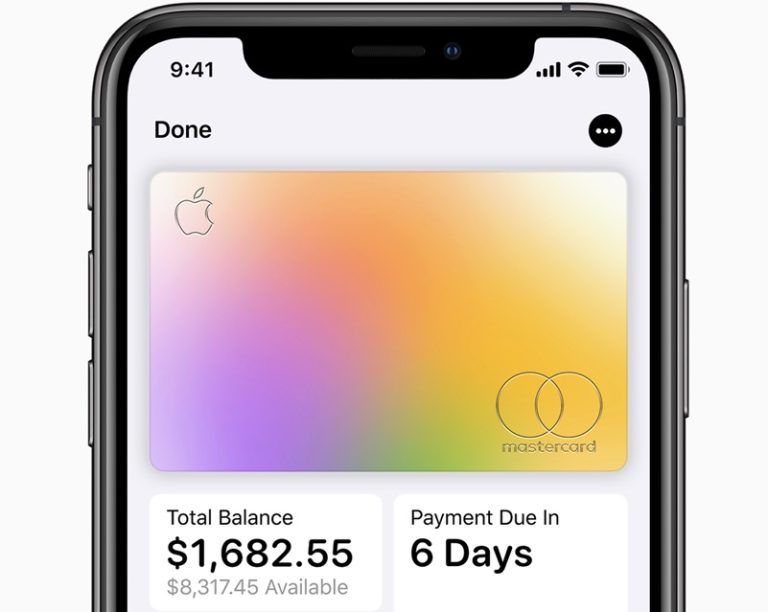

As an Apple Card user from the beginning, I was part of that early demand that Solomon referred to during his investor comments. Reasons I jumped at the opportunity to sign up for the card include a lot of small things that nevertheless represent a vast improvement over the card industry’s status quo. Things like the ability to keep a digital version of the card in your iPhone Wallet app without needing to own a physical version of the card (which, of course, can get stolen or lost).

But even if you choose to own a physical version of the card, its security protections include the absence of a card number printed on the card itself. Furthermore, Apple Card owners have the ability to generate a new card number on the fly instantly if they’re ever concerned about a security issue. There’s also an opt-in feature whereby Apple will regularly generate a new three-digit CVV number for your card, adding even more peace of mind.

These are features, honestly, that I wish were baked into every major credit card product so that I didn’t have to worry as much about my data leaving one purchaser and ending up in the hands of some third-party broker — or who knows where else.

Certainly, Apple Card isn’t perfect, with one of my main gripes being that the rewards offered are nothing at all to get excited about. However, the daily cash back on purchases (3% when you buy from Apple, 2% when you use Apple Card with Apple Pay, and 1% with everything else) makes up for that to some degree.

The other things I mostly haven’t liked about the card, like random charges getting declined for no reason and the slow response time from customer service, fail squarely within the purview of Goldman and the infrastructure it set up to service the card. Supposedly, among the many things that the company didn’t like about Apple Card was the lack of any fees, and also the way everyone’s bill is due at the end of every month — at the same time for everyone, in other words, which can make for a deluge of customer inquiries that come all at once.

I’m not sure why Goldman, an extremely sophisticated and venerable financial institution, wasn’t aware of those kinds of details as part of the full Apple Card picture going into this arrangement, but that’s neither here nor there. Goldman’s sweet spot has always been wheel-heeled customers with deep pockets, not peons like me. Meanwhile, don’t mistake Apple’s temporary loss of a partner here for any kind of judgment on the card product itself, which brought some sorely needed innovations to an industry that’s long been unfriendly to consumers.