- As the coronavirus pandemic has dragged on, one of everybody’s go-to entertainment options, while we’re all quarantined at home, is a Netflix binge session.

- Accordingly, analysts are expecting a big increase in the streamer’s subscriber base when Netflix reports its latest quarterly earnings next week.

- Visit BGR’s homepage for more stories.

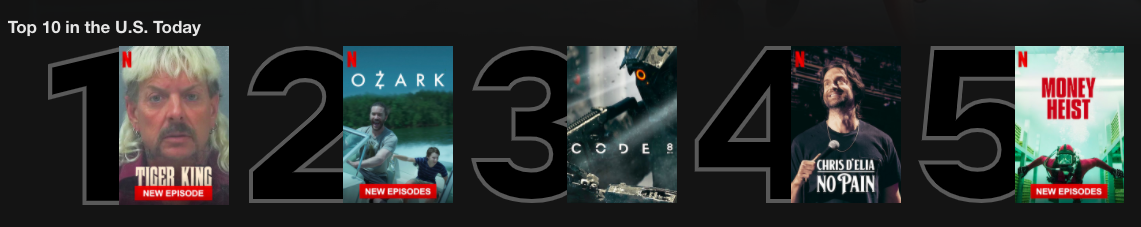

Here’s a development everyone should have been able to see coming from a mile away. The coronavirus pandemic that’s resulted in widespread quarantines and stay-at-home orders around the world means that several million new people have since decided they can’t live without the service that gave the world such hot TV properties during the quarter as Tiger King and the third season of Ozark.

That’s according to new analyst estimates about Netflix’s subscriber base during the same quarter that saw the onset of the COVID-19 crisis which has brought daily life in the US and most of the rest of the world pretty much grinding to a halt. One of the tried-and-true entertainment pursuits you can enjoy while hunkering down at home, though, is a Netflix binge — with this fact leading analysts to expect a huge quarterly performance when the streamer provides its latest earnings update next week.

“We raised our Netflix global subscriber forecasts materially on likely higher gross subscribers and lower subscriber churn boosted by global consumer ‘stay at home’ orders around COVID-19,” Pivotal Research Group analyst Jeff Wlodarczak wrote in a new report. “We believe the unfortunate COVID-19 situation is cementing Netflix’s global direct-to-consumer dominance partly driven by the incremental content spend that is enabled by their massive and growing subscriber base.”

For a rundown of the hottest Netflix series that users have been bingeing over the past week, which reflects both new programming and titles added throughout the quarter, click here. Because the company’s pipeline of content like that remains strong, Wlodarczak’s report includes a raised estimate for the streamer’s subscriber additions during the just-ended quarter — which he now pegs at 8.45 million, up from 7.9 million.

This also helps explain his increase in the price target for Netflix’s stock, which he raised by $65 to now $490 a share. One additional point he addresses in his report is his assessment that Disney+ at this point seems more complementary than competitive with Netflix. That, in fact, Disney+ will probably steal more from traditional TV, instead of Netflix.

“We remain bulls on the Netflix story, as Netflix offers consumers an increasingly compelling unique entertainment experience on virtually any device without commercials at a relatively low cost,” wrote Wlodarczak. “The company appears to operate in a virtuous cycle, as the larger their subscriber base grows (and their average revenue per user increases) the more they can spend on original content, which increases the potential target market for their service (and reduces existing subscriber churn) and enhances their ability to take future price increases and dramatically increases barriers to entry, boosted by continued material increases in broadband availability/speeds globally.”