The early February 2018 crypto bloodbath continued on Monday, with Bitcoin and all the other digital coins continuing to plunge to new lows. Well, the new lows are relative to how you look at the market. Bitcoin trading at around $7,600 sounds like bad news for late traders who bought in at prices near the all-time high of nearly $20,000 in mid-December. But for many people, Bitcoin and all other coins are still profitable, even after market caps of all digital coins have dropped back down to early-December levels.

News over the weekend killed Bitcoin’s brief rally. After climbing to nearly $9,500 on Friday, Bitcoin plunged below $8,000 on Super Bowl Sunday. Three US-based lenders decided not to accept credit card payments for cryptocurrency purchases, while news from China said the country will enforce its exchange ban on international companies that still support Chinese traders.

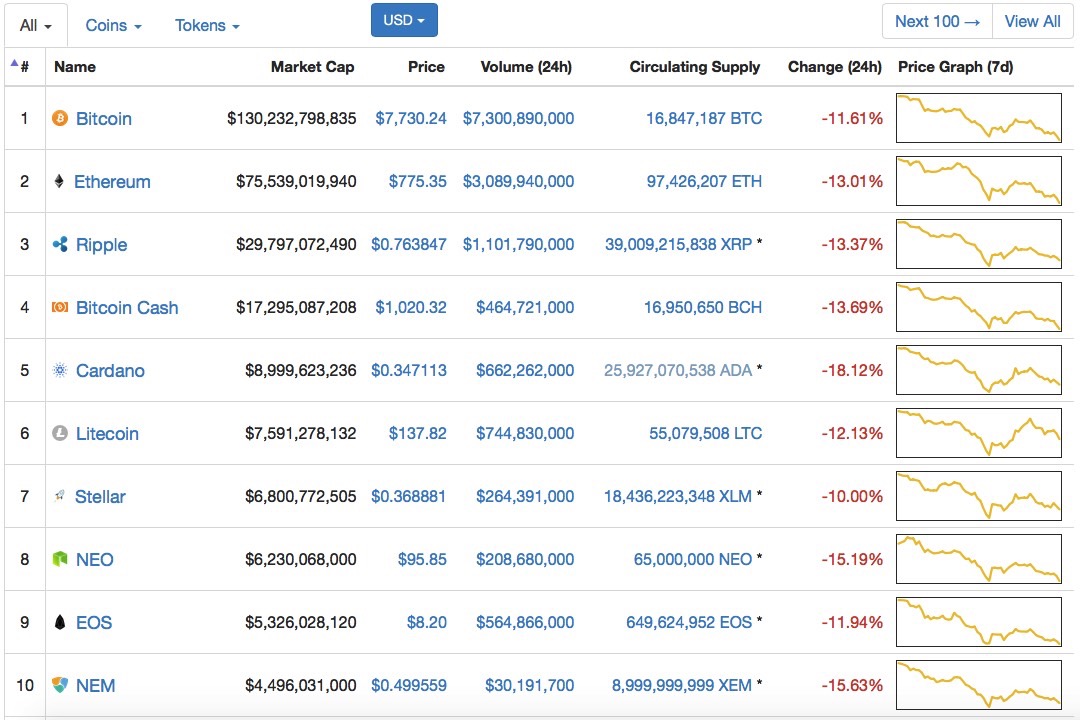

The plunge continued on Monday morning, with prices dropping to even lower levels — we’re looking at price drops across the board, with the top 10 crypto coins by market cap trading at between 12% to 20% lower than they were on Friday.

It looks like UK-based credit card companies are just as spooked as JP Morgan Chase, Bank of America, and Citigroup when it comes to the risk associated with crypto purchases. Per Reuters, Lloyds Banking Group, Britain’s biggest lender, announced on Sunday that it will ban credit card customers from buying crypto coins.

The worry is that customers will run up huge debts because of the volatility of the market. Debit card customers, meanwhile, will still be able to pay for cryptocurrency online.

A Monday report from South China Morning Post reinforced the idea that China is clamping down on all Bitcoin trading. The report quotes the same Financial News report that emerged on Sunday night, a publication affiliated with the People’s Bank of China.

“To prevent financial risks, China will step up measures to remove any onshore or offshore platforms related to virtual currency trading or ICOs,” the article said.

China first banned local exchanges in September, temporarily denting Bitcoin’s price. But some exchanges simply relocated to nearby markets, while Chinese traders employed services like VPN’s to circumvent bans.