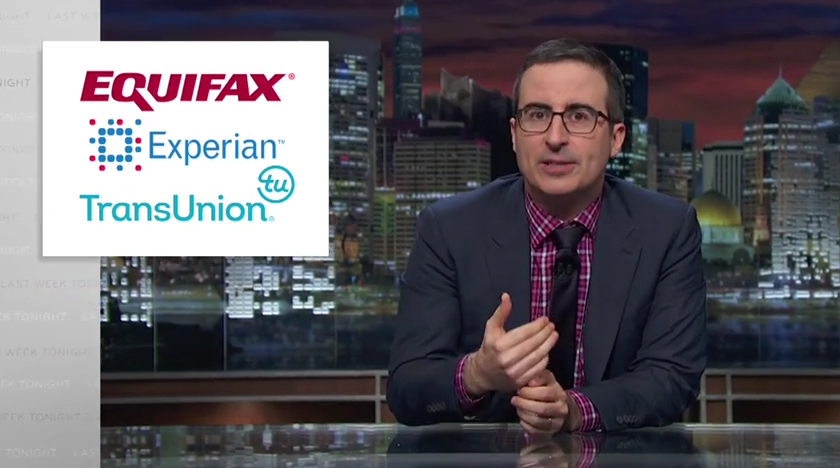

The latest episode of Last Week Tonight tackled another major subject that will always affect your life: Credit reports. Specifically, HBO’s John Oliver took a closer look at credit reporting errors, as well as the companies who are responsible for the mistakes that end up in your credit reports. Furthermore, John Oliver also explained how credit background checks work and goes into how they are riddled with errors that could prevent you from getting a job or apartment.

DON’T MISS: There’s an addictive new YouTube channel dedicated solely to melting stuff

As he normally does, Oliver took a humorous approach to a very serious issue. According to studies, some 25% of consumers have an error in one of their credit reports. More disturbingly, about one in 20 consumers had significant errors that would result in higher car loan or mortgage payments. Furthermore, some 47% of employers ask for credit checks, even though there’s no real correlation between credit checks and job performance.

Even worse, background checks may contain similar errors that would have adverse effects on a person’s life, and could be even worse than the errors that appear in credit reports. HBO found that it’s difficult for a person to purchase his or her background check to verify that the information is accurate, but employers would still be able to get it. Furthermore, it’s not even clear how many companies out there provide such services.

The full segment on credit reports is available below and you’ll want to stick around for the ending. Without spoiling it, we’ll just tease that Oliver found the perfect solution for trolling Equifax, Experian, and TransUnion, the three main credit reports providers.