When you consider the latest global smartphone marketshare data from Gartner, which highlights a protracted industry slump in terms of handset sales, it starts to put things in perspective — Samsung, for example, deciding it needs to dramatically shake things up and give something new a try, like a foldable phone.

Gartner’s newly released data shows, among other things, that global smartphone sales was essentially flat during the recent holiday quarter — up just 0.1 percent compared to the fourth quarter of 2017, with 408.4 million units shipped.

Gartner also notes that Apple during the holiday quarter recorded its worst quarterly decline in sales for the iPhone maker since the first quarter of 2016. And all of this is at least partly attributed to the reality of consumers hanging on to their pricey handsets for longer before they decided to upgrade.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018,” said Anshul Gupta, senior research director at Gartner, about the new data. “Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones. This led to a flat-growth market in the fourth quarter of 2018.”

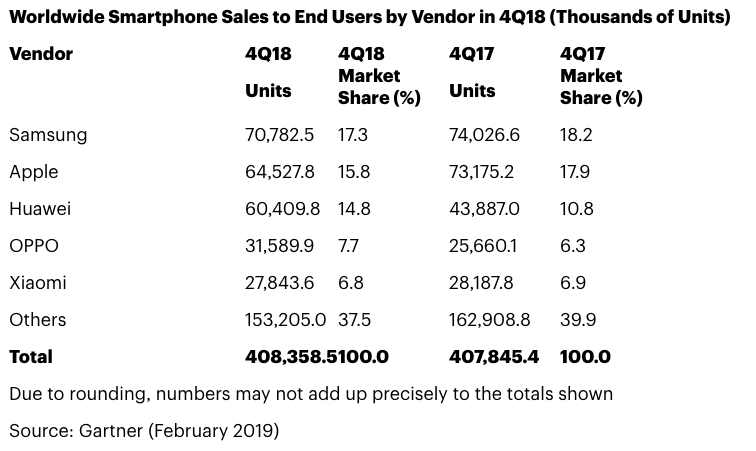

While Apple suffered a precipitous drop in smartphone sales, it’s also worth pointing out that the company is still hanging on to its number two spot as ranked by market share, according to the Gartner data:

Also during the holiday quarter, Samsung retained its spot atop the market share rankings while continuing to see its handsets like the Galaxy S9, S+ and Note 9 struggle to grow during the quarter. The company’s sales were down 4.4 percent, while at the same time Chinese brands like Xiaomi and Huawei saw their market share grow while nevertheless being shut out of lucrative Western markets like the US.

In fact, Gartner’s new report describes 2018 as “the year of Huawei,” noting that the company sold more than 60 million handsets and “achieved the strongest growth of the quarter among the top five global smartphone vendors.”

“In 2018 as a whole, global sales of smartphones to end users grew 1.2 percent year over year, to 1.6 billion units,” Gartner’s new data reveals. “North America, mature Asia/Pacific and Greater China recorded the worst declines of the year, at 6.8 percent, 3.4 percent and 3.0 percent, respectively.”