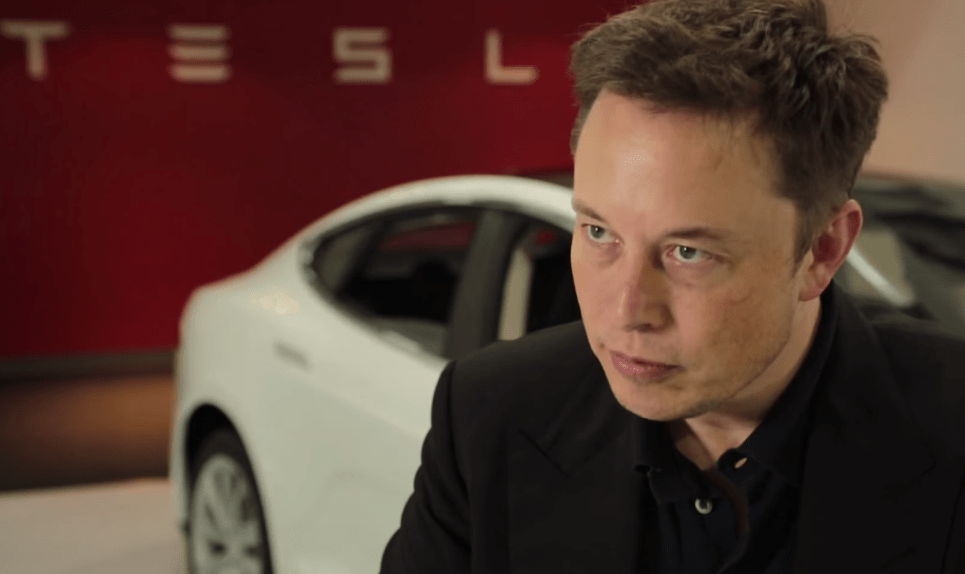

Nearly a week after Elon Musk first tweeted a plan to take Tesla private at $420 a share, America’s second-tweetiest billionaire finally added some detail to the plan. In a post on Tesla’s corporate blog, Musk explained that the Saudi Kingdom Public Investment Fund first approached Musk about taking Tesla private two years ago, and that its oil-funded war chest would be putting up the cash for the transaction.

Musk also said that based on his current estimates, two-thirds of Tesla’s current investors would remain in the privatized company, which would dramatically reduce the amount of money needed to take the company private.

“On August 2nd, I notified the Tesla board that, in my personal capacity, I wanted to take Tesla private at $420 per share,” Musk wrote. “This was a 20% premium over the ~$350 then current share price (which already reflected a ~16% increase in the price since just prior to announcing Q2 earnings on August 1st). My proposal was based on using a structure where any existing shareholder who wished to remain as a shareholder in a private Tesla could do so, with the $420 per share buyout used only for shareholders that preferred that option.”

“The only way I could have meaningful discussions with our largest shareholders was to be completely forthcoming with them about my desire to take the company private. However, it wouldn’t be right to share information about going private with just our largest investors without sharing the same information with all investors at the same time. As a result, it was clear to me that the right thing to do was announce my intentions publicly. To be clear, when I made the public announcement, just as with this blog post and all other discussions I have had on this topic, I am speaking for myself as a potential bidder for Tesla.”

Musk’s tweets have reportedly been under investigation by the SEC, particularly related to the use of the term “funding secured” but also how he disclosed the details to investors.

There are two major details that this blog post clears up: Firstly, the funding would come from the Saudi sovreign wealth fund, which already owns around 5% of Tesla’s stock, and sees the company as a hedge against oil. Secondly, although the source of the potential funding is clear, there exact details of any plan — and how far the Saudi fund is committed — are still not public.