iPhone Crushed Android Last Year In Record-Breaking Fashion

Apple on Thursday posted its earnings report for the December 2023 quarter, or the first quarter of fiscal year 2024. Revenues of $119.58 billion beat expectations for the period, although it's not quite a record, falling short of the $123.9 billion from the December 2022 quarter. Out of that, $33.9 billion represents profit for the quarter.

Put differently, the iPhone accounted for $69.7 billion in revenue, or almost 60% of product sales for the period. That's just crazy, and something rivals can't match. It also happened during a slower year for the smartphone business in general, as most companies suffered.

Beyond exceeding Apple's expectations, the iPhone crushed Android like never before as well. Counterpoint Research provided the data in two reports highlighting how uneven the playing field was during not just the fourth quarter of 2023 but the entire year.

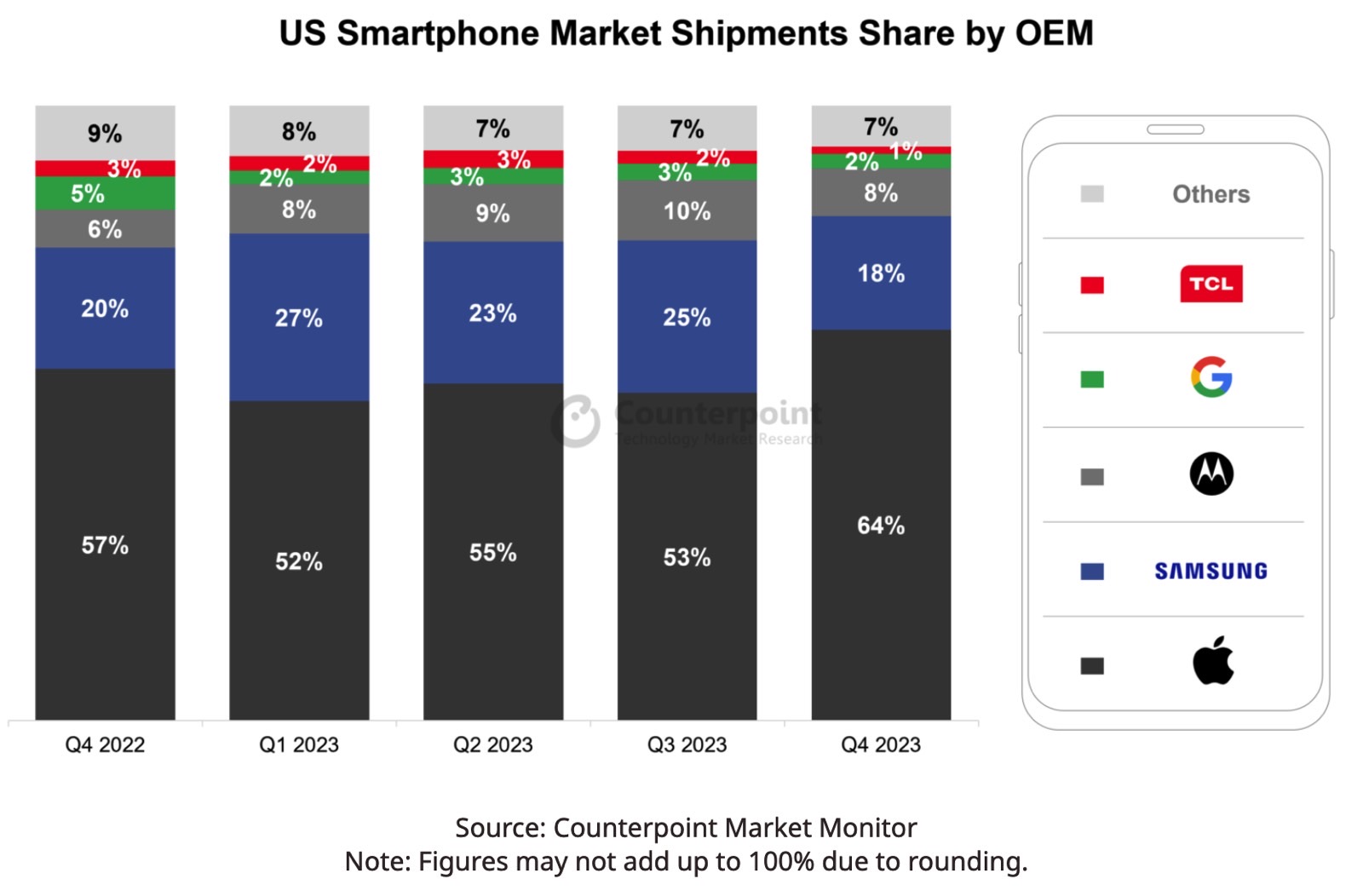

The iPhone accounted for 64% of US smartphone sales during the December 2023 quarter. Counterpoint Research explains that Apple's massive quarter helped the entire US smartphone shipments grow 8% year over year during the period.

The report also points out that while Apple kept selling more iPhones than in the previous quarters, Android vendors struggled to move sub-$300 devices. Samsung came in second with 18% of sales in the US, and Motorola took third place with 8%. Google's Pixels accounted for 2% of the market.

The Counterpoint researchers expect the US market to see low single-digit growth in 2024 as the economy rebounds.

In a separate report, Counterpoint Research highlighted the iPhone's performance internationally for the entire year of 2023.

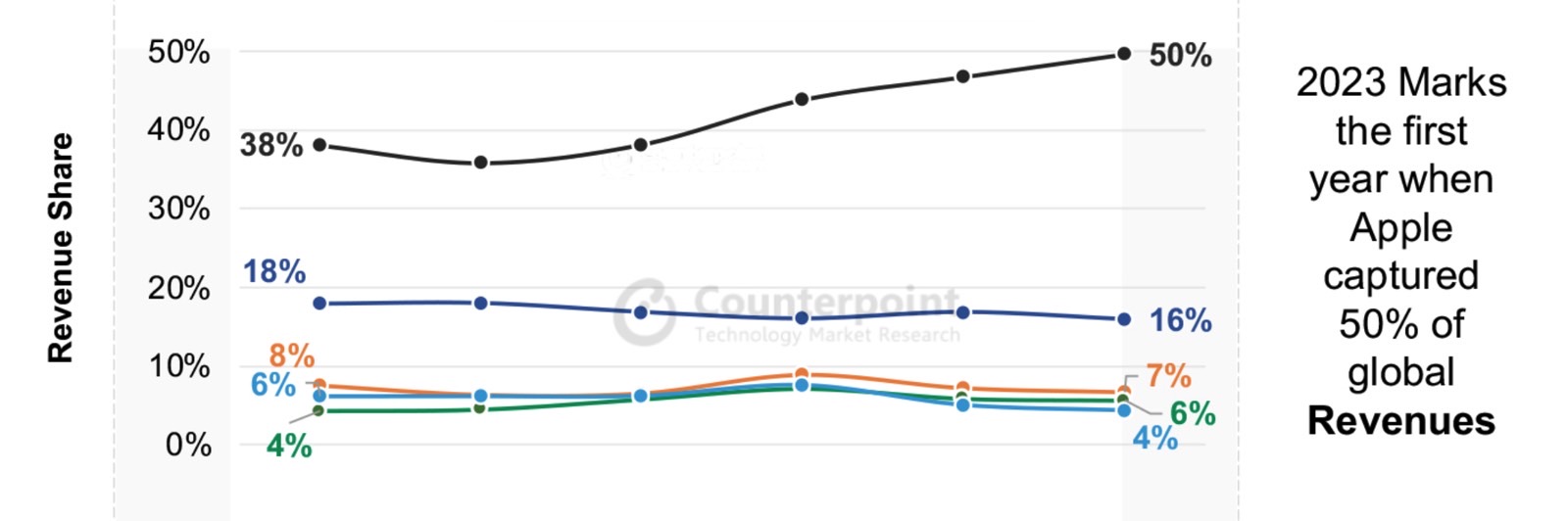

Apple might not reveal iPhone sales figures, but we might not need them. The research firm provided other stats that show how massive Apple's dominance is. The iPhone accounted for 50% of global smartphone sales revenue last year.

This is the first year Apple has reached that figure. That's half of the almost $410 billion in sales this year. Smartphone sales dropped 2% in 2023 compared to 2022, accounting for revenue of "a little under $410 billion."

Moreover, smartphone shipments dropped by 4%, down to 1.17 billion units in 2023. Most of the smartphones sold last year were Android devices, however. Apple ships at least 200 million units a year on average. The point here is the iPhone captured 50% of revenue without also accounting for 50% of the marketshare.

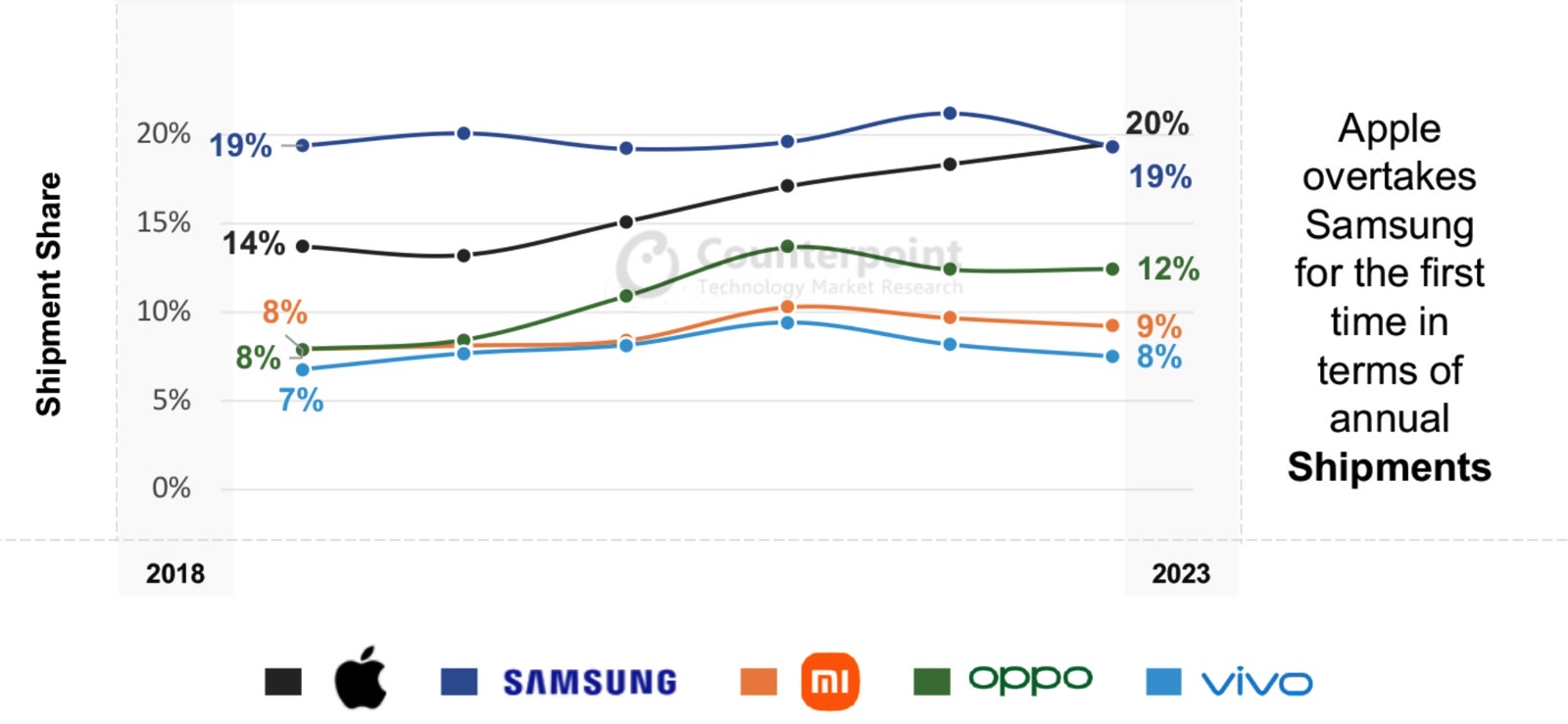

The same report notes that Apple overtook Samsung for the first time in terms of annual sales. Apple reached 20% of the market. That would amount to some 234 million iPhone units. Samsung came in second with 19%.

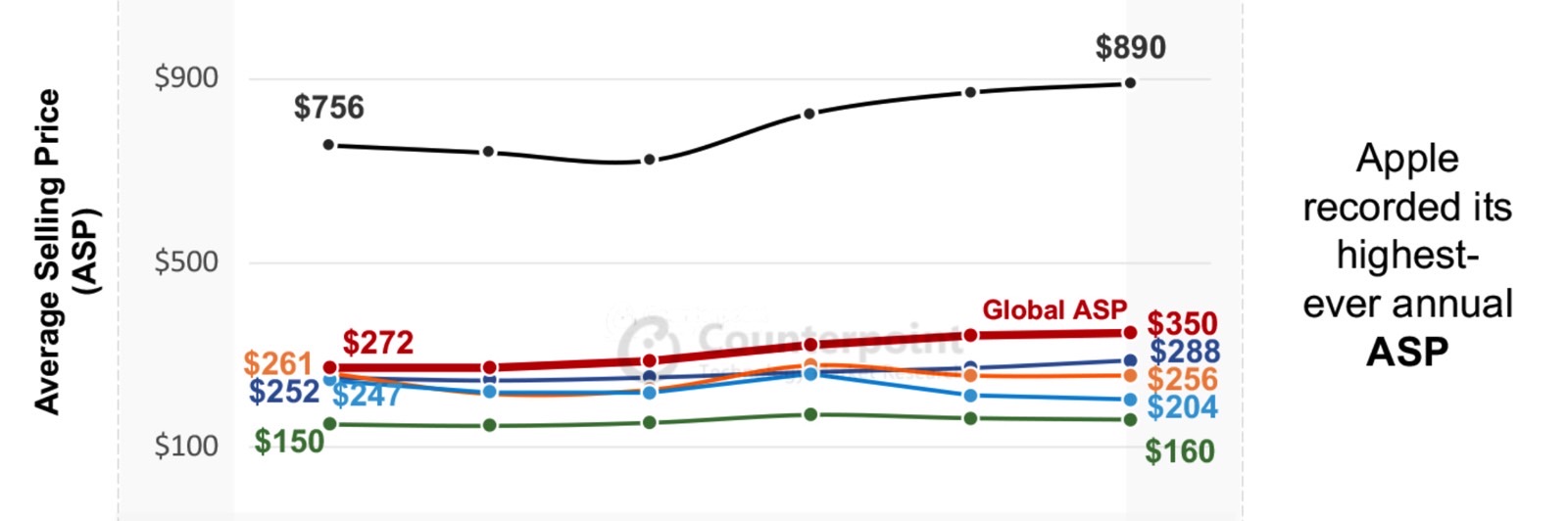

If that's not enough, the iPhone's average selling price (ASP) kept rising in 2023, reaching $890. Samsung's ASP came in second, rising as well compared to 2022. But Samsung's $288 ASP pales in comparison. The Global ASP rose to $350 last year, largely driven by the iPhone.

It's not just the US that helped Apple crush Android last year. The iPhone saw growth in various other key markets, which might have offset slower sales in China. That's according to Counterpoint Research director Jeff Fieldhack:

Apple displaced Samsung as the biggest player in shipments for the first time in a full year. While the US made the biggest volume contribution to Apple's growth, it also received a major boost through double digit growth in emerging markets including India, Caribbean and Latin America (CALA) and Middle East and Africa (MEA).

This growth offset any challenges Apple may have faced in China due to the resurgence of Huawei. With an accompanying ASP growth of 2%, it can be seen to be in a revenue super-cycle, buoyed by its ecosystem stickiness coupled with the premiumization trend, crossing an annual revenue of $200 billion.

The iPhone saw increased competition in China last year, and the market might continue to represent a concern in the coming months and years. The resurgence of Huawei in the premium segment threatens iPhone 15 sales. Other local Android vendors will put pressure on Apple's older models (iPhone 13 and iPhone 14) in the near future.