iPhone 13 Sales Propel Apple To The Top Of The Chinese Smartphone Market

The Chinese smartphone market is incredibly competitive, making it nearly impossible for international companies to dominate. That's because local vendors offer extremely competitive prices for high-end devices. That makes it more challenging for companies like Apple and Samsung to compete. Yet the former still manages to sell plenty of phones every year. Moreover, Apple has done something incredible over the course of the holiday 2021 quarter. iPhone 13 sales propelled the company to the top of the Chinese smartphone market.

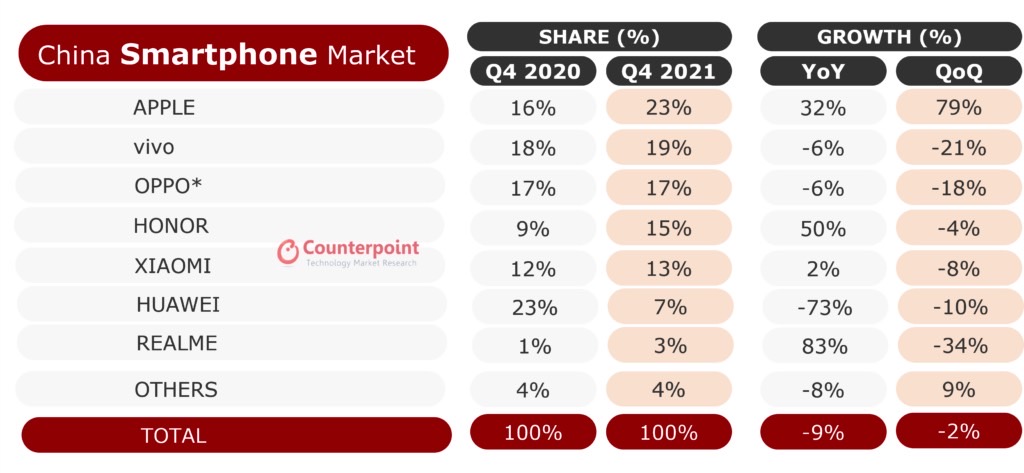

Apple outsold every smartphone maker in the region, a feat unseen since the iPhone 6 supercycle (the December 2014 quarter). iPhone sales accounted for 23% of the market, Counterpoint Research reported in a new research note. That's the highest ever market share for Apple in China.

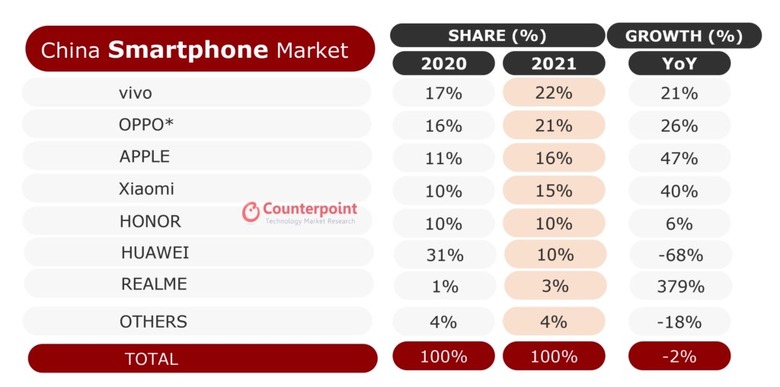

Smartphone sales dropped in China by 9% compared to the December 2020 quarter, marking the third consecutive quarter of declines. Full-year sales dropped by 2% in 2021 compared to the previous year. That's the fourth straight year of declining sales.

That's what makes Apple's accomplishment even more astonishing. The iPhone sales accounted for nearly one in four smartphone sales during the December 2021 quarter. Sales might be declining overall, but the iPhone is an expensive device, especially the newest models. The iPhone 13 series might have the same price as the iPhone 12, but it's still an imported device in China. It has to compete against more attractively priced handsets from local vendors.

Moreover, Counterpoint notes that competition has intensified in the region after Huawei's decline. The US ban impacted Huawei's ability to compete, even in China. As seen in the chart above, Huawei hasn't even made the top five for the fourth quarter of 2021.

iPhone 13 sales key to Apple’s success

Huawei is tied with Honor for fifth place in China for overall sales in 2021. The latter used to be a division of Huawei before becoming its own entity. As for Samsung, it's part of the "others" group.

Apple made the top three for the entire year, just like in 2020. But its share rose from 11% to 16%. Vivo and Oppo outsold the iPhone in China last year, accounting for 43% of the market in total. The two companies are part of the same giant conglomerate. Also, OnePlus sales are factored into the Oppo performance.

But the iPhone 13 sales helped Apple outsell these two rivals in the December quarter. Counterpoint Research Analyst Mengmeng Zhang explained the sales dynamic following the iPhone 13 introduction:

"Apple's stellar performance was driven by a mix of its pricing strategy and gain from Huawei's premium base. Apple rose to first place in China right after the iPhone 13 was released (week 39) in September. Afterwards, it remained in the leading position for most of the fourth quarter. The new iPhone 13 has led the success due to a relatively lower starting price at its release in China, as well as the new camera and 5G features. Furthermore, Huawei, Apple's main competitor in the premium market, faced declining sales due to the ongoing US sanctions."

The Counterpoint analysts also explained the factors that impacted overall smartphone sales in the region. They cited both issues with supply chains and demand. The ongoing chip shortage affected all vendors, just as China's average smartphone replacement cycle is lengthening.