AI Agents Like ChatGPT Will Soon Shop For You Thanks To New Tech

We're in the early days of AI agents, or tools available in ChatGPT that perform specific actions for users beyond answering questions. AI firms like OpenAI have demonstrated the kind of agentic behavior these tools can achieve.

For example, ChatGPT Operator can browse the web to find specific information. ChatGPT Deep Research is another type of agentic behavior, where the AI conducts research for you. Some AI agents can also help with coding.

One common example AI firms use to highlight the potential of AI agents is shopping. You can ask the AI to purchase items for you, including physical products, travel, or restaurant bookings.

Some of these demos already function. AI like ChatGPT Operator can browse the web and find the product you need, but they won't actually complete the purchase. Instead, they prompt you to enter payment details once you've confirmed the AI completed the task correctly.

As a longtime ChatGPT user, I still wouldn't trust the AI to shop for me. I'd want to confirm all the information and input payment details myself. In other words, you don't trust the AI with your credit card number. We're not there yet.

But we might never have to, as payment providers like Visa, Mastercard, and PayPal are preparing for a future where AI handles the full shopping experience, from searching for products to making the purchase and tracking the order.

These companies have introduced credit card technologies designed to let users trust AI with payment info, ensure transaction safety, and control AI-driven spending.

Mastercard

Mastercard on Tuesday announced a new Agentic Payments Program, Mastercard Agent Pay, which will let users and merchants conduct online transactions through AI agents.

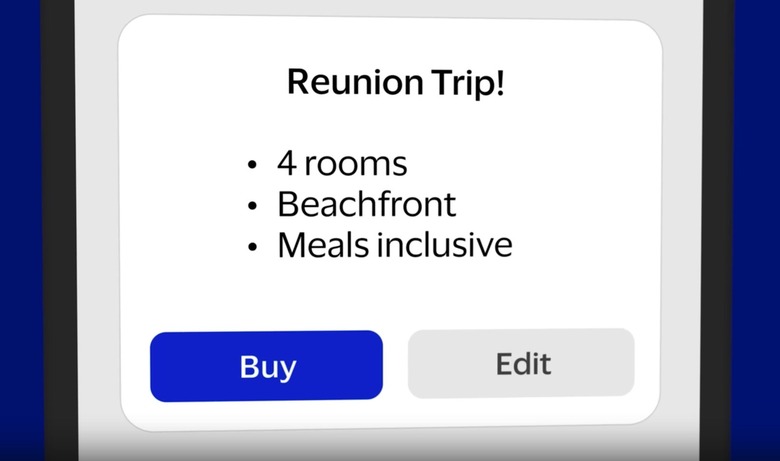

Mastercard provides the following example of someone using an AI agent to buy items with a Mastercard:

This means that for a soon-to-be-30-year-old planning her milestone birthday party, she can now chat with an AI agent to proactively curate a selection of outfits and accessories from local boutiques and online retailers based on her style, the venue's ambience, and weather forecasts. Based on her preferences and feedback, the intelligent agent can make the purchase, and also recommend the best way to pay, for example using Mastercard One Credential.

Mastercard's tech could also be used in business-to-business scenarios, where AI agents manage supply procurement and logistics.

Trusted AI agents will be registered and authenticated before making purchases on a user's behalf. Mastercard will use "enhanced tokenization tech" to support payments initiated through conversational commands, such as asking the AI to buy a specific outfit.

The AI will access a unique tokenized version of the user's 16-digit credit card number, not the actual code. This tokenization is already used in e-commerce to secure transactions.

Users will also be able to define rules for their AI agents, such as setting purchase limits and allowed categories.

The company also plans to use strong anti-fraud tools to protect consumers and merchants. Some AI purchases may require user authentication via on-device biometrics if the transaction seems unfamiliar or suspicious.

Mastercard is working with Microsoft on this AI initiative.

Visa

On Wednesday, Visa announced its own AI-driven e-commerce solutions. Visa Intelligence Commerce offers similar features to Mastercard's, with even broader partnerships.

Visa's secure payments technology for AI-powered shopping could integrate with tools from Anthropic, IBM, Microsoft, Mistral AI, OpenAI, Perplexity, Samsung, Stripe, and others.

"Soon people will have AI agents browse, select, purchase and manage on their behalf," said Visa Chief Product and Strategy Officer Jack Forestell. "These agents will need to be trusted with payments, not only by users but by banks and sellers as well."

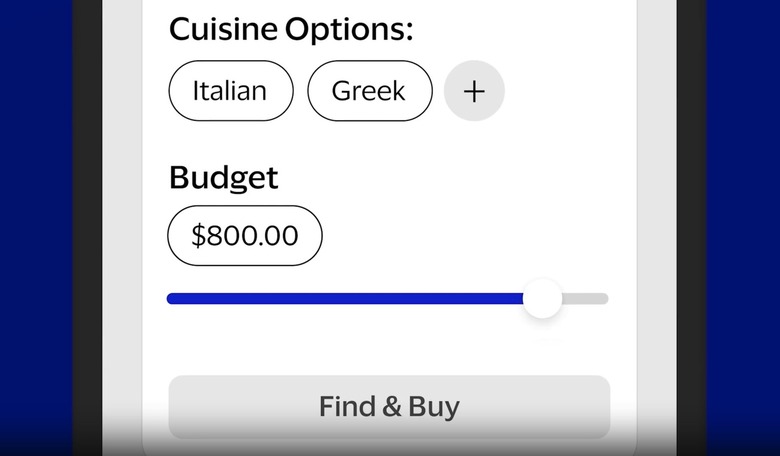

Visa, like Mastercard, will ensure that people remain in control of transactions. The AI will follow rules set by the user, including budget constraints, and all transactions will be secured.

Visa's AI-ready cards will use tokenized credentials that verify the identity of an AI agent authorized to act on the user's behalf. Only the user can instruct the agent to activate payment.

User-defined limits will help ensure safe transactions. Visa will monitor commerce signals in real time to manage disputes and enforce controls.

Visa also introduced an AI-powered personalization feature that allows AI agents to access basic spending data. This can help improve suggestions based on your purchase history.

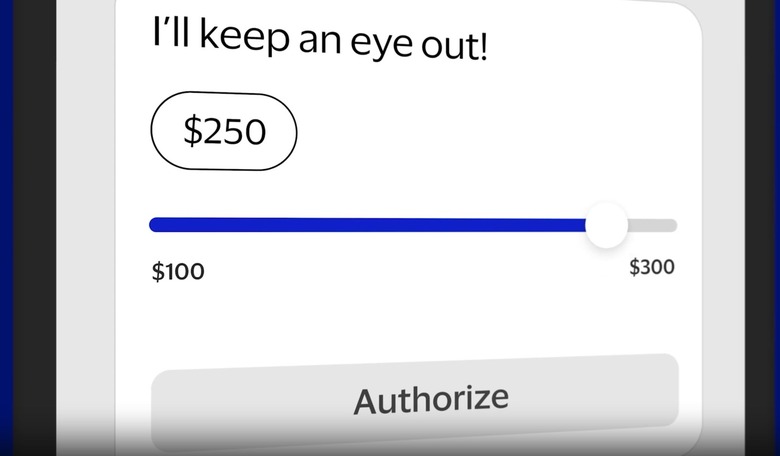

Visa shared a demo showing how users can initiate shopping sessions via AI, receive notifications, or choose to complete purchases with biometric confirmation. Users can also assign budgets and let the AI handle the process.

Visa imagines future use cases where buyers instruct AI to monitor certain shops for specific products and buy them within a set budget. This is speculative, but it's a natural extension of current capabilities.

Take the Switch 2's sold-out status. Wouldn't it be great to ask ChatGPT to monitor Walmart stock and buy the Switch 2 and accessories using Visa Intelligence Commerce and your predefined budget?

PayPal

PayPal also announced new tools on Tuesday to support AI-driven shopping. Its Agent Toolking and Model Context Protocol will enable agents to manage shopping sessions, including secure checkout and shipment tracking.

It may not be long before AI-ready payment protocols allow products like ChatGPT, Gemini, and other chatbots to shop on our behalf.

Google has already brought AI features to shopping, like using Google Lens to find products online or in stores.

Shopping with ChatGPT

OpenAI just announced plans to improve product comparisons in ChatGPT. It's not quite a full agentic feature, but it brings us closer to asking ChatGPT to make purchases directly.

I've been using Deep Research for detailed shopping reports and to make travel plans. Add payment capabilities to that, and you get an AI shopping experience powered by the latest tech from Mastercard, Visa, or PayPal.