Samsung And Apple Drive Huge Smartphone Growth In Q3

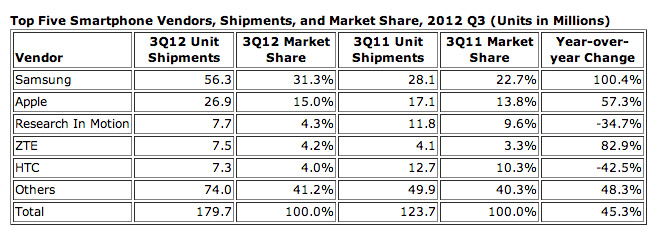

Worldwide shipments of mobile phones grew 2.4% year-over-year in the third quarter of 2012, according to the latest numbers from IDC. Vendors shipped a total of 444.5 million handsets compared to 434.1 million units in the third quarter of 2011. The firm also found that worldwide shipments of smartphones increased more than expected from 127.7 million units in Q3 2011 to 179.7 million devices last quarter, representing a 45.3% increase. Rival research firm Strategy Analytics estimated that shipments increased only 35%, however, from 120 million units in the third quarter last year to 161.7 million in Q3 of 2012. Both firms note that the continued success of Samsung (005930) and Apple (AAPL) have contributed greatly to market growth.

Samsung in the third quarter led all shipments with 56.3 million units for a 31% share of the market, while iPhone shipments totaled 26.9 million units for a 15% share. Research in Motion (RIMM) continued its fall with smartphone shipments of 7.7 million units, down from 11.8 million in 2011, for a 4.3% market share.

China's ZTE shipped 82.9% more smartphones in the third quarter this year than it did last year — a growth rate that was bested only by Samsung. Shipments of HTC (2498) smartphones tumbled in the third quarter to 7.3 million units for a 4% market share and a year-over-year decline of 42.5%. The Taiwanese company looks to rejuvenate its global shipments with its new Windows Phone 8 devices, the 8X and 8S.

In the third quarter, Samsung extended its lead over Nokia (NOK) in the overall mobile market. The South Korean company shipped a total of 105.4 million units during the quarter for a record 23.7% share of the market. Nokia continued its restructuring plans and shipments from the fallen global leader fell 22% from 106.5 million in Q3 2011 to 82.9 million last quarter.

"Nokia is not the only smartphone vendor in transition," said Ramon Llamas, research manager with IDC's Mobile Phone team. "Research In Motion, although still a market leader, expects to start shipping its first BB10 devices in 2013. Motorola, once the number 3 smartphone vendor worldwide, is redirecting itself under its parent company Google. These are just two vendors among many that feel the competitive pressure of Samsung and Apple, but are striving to create multiple points of differentiation to assert upward pressure."