Facebook's Libra Coin Isn't Even Out Yet, But It's Already Facing Opposition In Europe

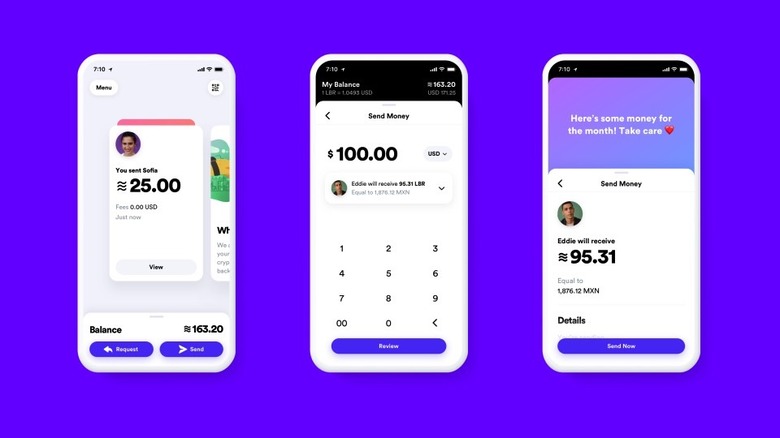

Facebook on Tuesday announced the Bitcoin rival it has been developing for the better part of a year: Libra. From the start, Facebook insisted on how secure Libra would be, and on the fact that a subsidiary called Calibra will be in charge of Libra, and that a Libra Association would oversee the Libra blockchain.

It's as if Facebook wanted to ensure everyone ahead of Libra's 2020 launch that the coin won't be another way for the company to make money off of its customers by collecting even more personal data from them. We told you before the announcement that you should avoid Libra at all costs until Facebook proves it can be trusted with our privacy. But now that Libra is official, it's already facing opposition out of Europe.

As the recent past has shown, it's Europe that US tech companies have to fear. Google has been slapped with no less than three multi-billion dollar fines in anti-trust cases, and regulators in various countries aren't fans of Facebook in light of the recent scandals that plagued the social network.

Facebook's desire to handle payments won't go unnoticed or unscrutinized in the region, and the French finance minister Bruno Le Maire already commented on Libra. "It is out of question" that Libra "become a sovereign currency," Le Maire said in an interview with Europe 1 radio, per Bloomberg. "It can't and it must not happen."

The official also called on the Group of Seven central bank governors to prepare a report on Facebook's project for the upcoming July meetings. Le Maire's fears were echoed by Markus Ferber, a German member of the European Parliament who took to — wait for it — Facebook to say that with more than 2 billion users, the company could become a "shadow bank," and that regulators should be on high alert.

"Multinational corporations such as Facebook must not be allowed to operate in a regulatory nirvana when introducing virtual currencies," said Ferber.

The other day I said that Libra does have one advantage over other cryptos: It can raise awareness about blockchain tech and digital currencies to teach more people about cryptocurrencies and the blockchain. In light of these first reactions from the EU, there's one other side-effect that Libra might have on the crypto space. It could convince more governments to take a closer look at cryptos, and issue stricter regulation.