China's Phones Are Slowly Conquering Europe, And Huawei Is Leading The Charge

Huawei handsets are hardly to get in the US, where carriers do not sell any of its handsets, but the top Chinese smartphone maker is doing great in other markets. According to a recent report, Huawei is leading the charge in Europe, where more customers bought smartphones from China last year than ever before.

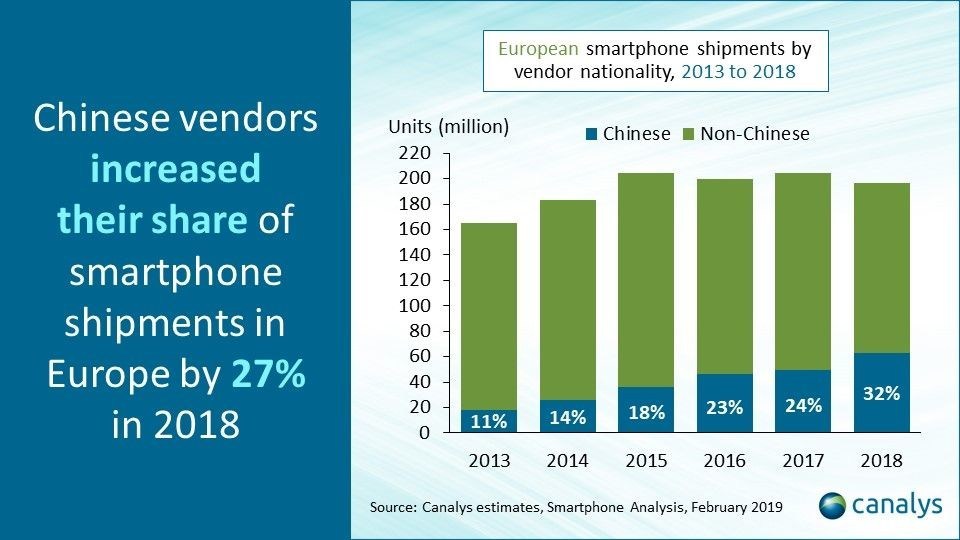

New data from Canalys shows that one in three smartphones sold in Europe last year came from a Chinese vendor, and Huawei made one in five phones sold in Europe during the Christmas quarter:

In other words, Chinese smartphones accounted for 32% of a shrinking European smartphone market in 2018, which represented a 27% increase for Chinese brands compared to last year. Huawei's share grew 54% last year, the company explained, accounting for 23.6% of sales in the final quarter of the year.

Samsung and Apple held the first two positions in the region, selling 61.6 million and 42.8 million smartphones, respectively, but both companies lost market share — over 10% and 6%, respectively.

Other notable mentions in the top five are Xiaomi and Nokia device maker HMD Global, although they sold significantly fewer smartphones than their competitors, at least according to the data available in the table below for the fourth quarter. Interestingly, companies like Oppo and OnePlus aren't mentioned by name, but it's likely that both of them will increase their presence in Europe as well.

Overall, the European market fell 4% in 2018 to 197 million units, while Q4 2018 shipments fell 2% to 57 million units.

Canalys says various factors are affecting the smartphone landscape in Europe, including political tensions between Chinese companies and the US government, but also the weaker performance of high-end devices in strong economies.

"The US administration is causing Chinese companies to invest in Europe over the US," senior analyst Ben Stanton said. "The European market is mature, and replacement rates have lengthened, but there is an opportunity for Chinese brands to displace the market incumbents. The likes of Huawei and Xiaomi bring price competition that has stunned their rivals as they use their size against the smaller brands in Europe."

Western European markets saw an overall drop in smartphone shipments last year of 8% down to 128 million units, but Central and Eastern European markets grew 5% during the period to 68 million units.

"There hasn't been innovation in the flagship smartphone space to entice customers to upgrade," the analyst said, referring to high-end devices targeting markets like the UK, Germany and Nordic countries. But a "transformation in the mid-range segment in 2018, with notch displays and dual cameras coming down to aggressive price points," saw mid-range phones priced up to $350 drive upgrades in countries where the average selling price is much lower. Smartphones priced between $200 and $350 grew 20% in Western Union in 2018. Chinese vendors make many of these phones, and Canalys expects Chinese companies to continue to grow across all price segments this year.

Coincidentally, earlier this week, US officials again warned allies against using Huawei equipment, this time referring to Huawei's 5G networking technology, over spying concerns.