New Study Says Last Year's Record-Breaking Bitcoin Price Was Actually A Fraud

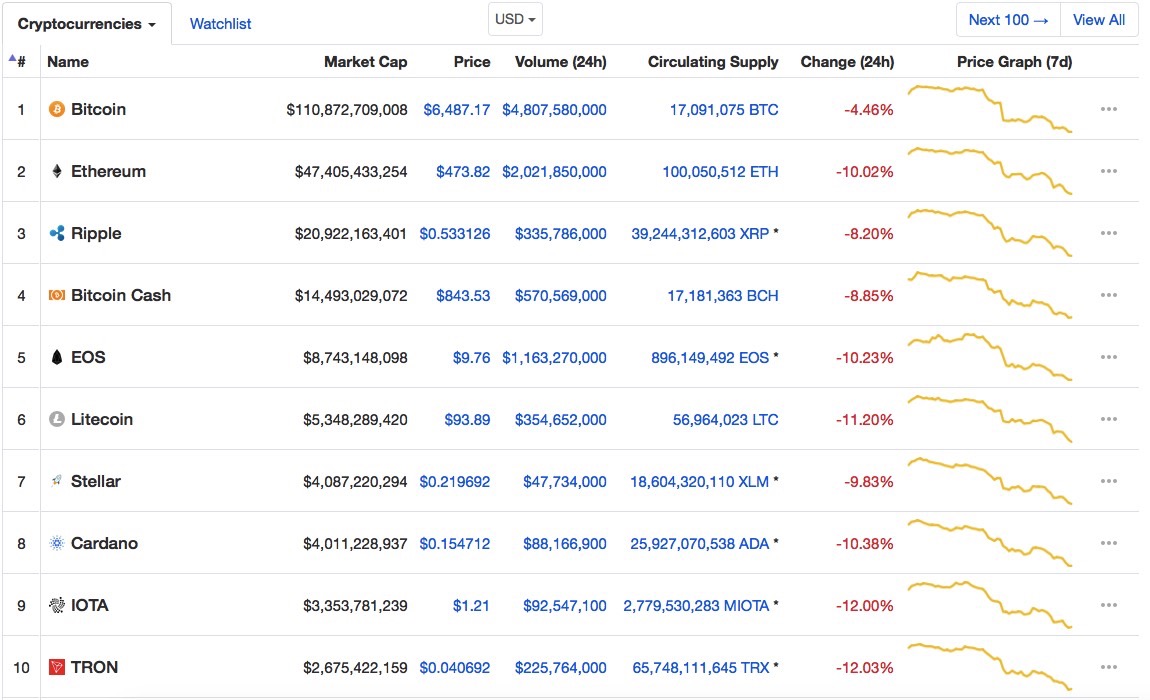

The bears are firmly in control of the cryptocurrency market, as Bitcoin and all the other coins have been on a free fall since Sunday. All tokens have been losing value consistently since late May, and there's no telling when the bleeding will stop.

More disturbing, a new study now claims that Bitcoin's incredible bull run last year was the result of manipulation via the use of a different token called Tether, which has seen its own share of controversies since its emergence.

For those of you not familiar with Tether, it's a token meant to help traders buy and sell cryptos for US dollars across exchanges and increase the speed of transfers. Rather than worry about fiat transfers, you can convert your money into Tether, and then do whatever you want with them in the crypto world. Every single Tether should always be valued at $1, and each Tether should be backed up by a real dollar. That sounds great on paper, and it's supposed to provide security to Tether users.

That's becauseTether should not be affected by bull or bear runs that routinely affect the crypto market. In fact, Sunday's bloodbath did not affect the digital currency. So that's all great news, yes?

Well, in spite of the various infusions of new Tethers into the market, nobody can prove that the real dollars backing them up exist. And currently, we have more than $2.5 billion Tethers out there, which means a bank should hold $2.5 billion in real dollars.

With all that in mind, let's look at what the new study is saying about Bitcoin manipulation. Researchers from the University of Texas on Wednesday published a paper (via Business Insider) that makes a remarkable claim.

The researchers found that the price patterns of Bitcoin are ""most consistent with the supply-based hypothesis where Tether is used to provide price support and manipulate cryptocurrency prices." The researchers looked at the relationship between Tether and the price of Bitcoin between March 2016 and March 2018 focusing on last year. The price rose to almost $20,000 in December and then dropped to $6,600 by March. It's now trading below that, with price hovering at around $6,480 at the time of this writing, and dropping.

"Tether seems to be used both to stabilize and manipulate Bitcoin prices," they said. New Tether coins were apparently created and used to buy Bitcoin when the coin was in low demand.

Many of the people behind Bitfinex created Tether, and they refute the study's conclusion.

"Bitfinex nor Tether is, or has ever, engaged in any sort of market or price manipulation," Bitfinex CEO JL van der Velde told Business Insider in a statement. "Tether issuances cannot be used to prop up the price of Bitcoin or any other coin/token on Bitfinex."

A few weeks ago we learned that the Justice Department is already investigating alleged Bitcoin price manipulation. Tether did not came up in that investigation, although it's likely on everyone's radar.

Needless to say, if Tether does turn out to be a massive fraud, its value will likely plummet, taking down the entire market to new lows.

The crypto market continued to slide on Wednesday — here's what it looks like at the time of this writing.