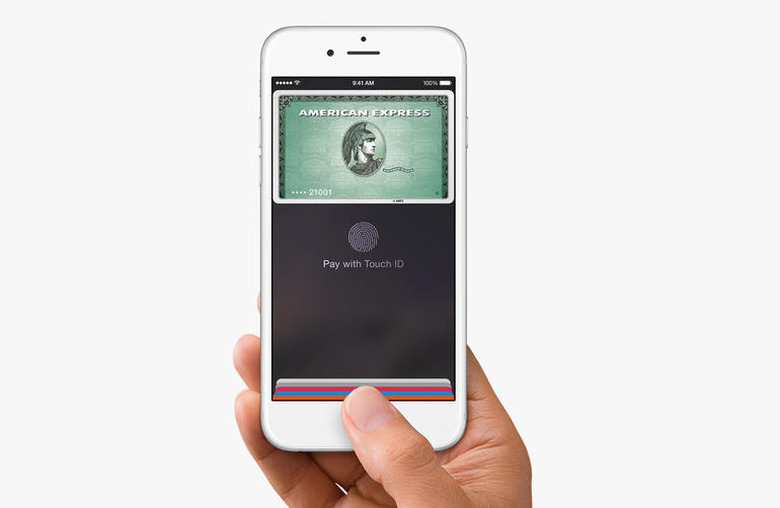

Why Apple Pay Is 'More Safe And Secure Than Using Your Credit Card'

Although Apple Pay has had its share of early hiccups, the mobile payment platform is overall off to a promising start. CIO's Al Sacco has interviewed three security experts for their views on the technology behind Apple Pay and the general consensus is that the platform is "more safe and secure than using your credit card."

RELATED: There's no chance your Apple Pay credit card info will end up like Jennifer Lawrence's nude pics

So why, you may be wondering, is this the case? A lot of it has to do with the clever token system that Apple has implemented.

In case you didn't know, your Apple Pay credit card information isn't stored on your iPhone or even on Apple's servers — instead, it's kept on your credit card company's secure network for safe keeping. When you need to make a payment at a store, your credit card company sends the retailer a 16-number token to your iPhone that acts as a "dummy" credit card number that gets stored on your phone's secure element. Other than the last four digits of the token, which do correspond with the last four digits of your credit card number, the token's number sequence is randomly generated and cannot be reverse engineered to decipher your credit card.

Catherine Pearce, a security consultant with Neohapsis, explains to CIO that this token system is what makes the system safer to use than credit cards since each token is used only for that one particular transaction — in other words, if a hacker breaks into a store's servers and takes that token, it won't give them access to your actual credit card number.

"Mobile payments have the capability to be far more secure than mag-stripe or even chip and pin credit cards, while being more convenient," Pearce tells Sacco. "I mainly see the advantage as convenience, [but] one-time transaction tokens (like the ones used in Apple Pay) may make direct financial loss from breaches of merchants a thing of the past."

Read Sacco's full report to learn more about why Apple Pay is more secure than credit cards by clicking the source link below.