Uber Can't Stop Losing Money

Uber has opened up its books for a rare examination, and the news is not good. From figures shown to Bloomberg, it would appear that Uber is taking in more revenue than ever before, but also losing money like crazy. For a company that is still yet to show its business plan is viable long-term, this isn't good news.

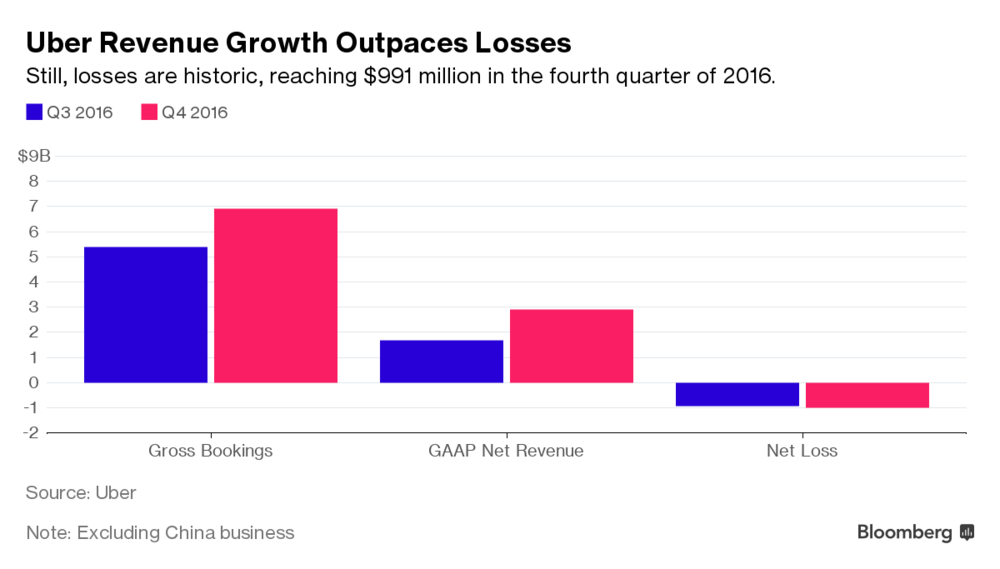

Bloomberg got the chance to examine Uber's financials from 2016, and by some metrics, things are good for Uber. The size of its business keeps growing at pace: gross bookings, or the total value of all fares collected from passengers, is up 126 percent in 2016, compared to the year before. Growth didn't slack off at the end of the year, either, as Q4 2016 was still 28 percent bigger than Q3.

Revenue, or the money that actually stays in Uber's pocket after each ride, is up as well, at just under $3 billion in Q4 2016. So based just on how much money is coming in, Uber is doing plenty to justify its $69 billion valuation.

Image credit: Bloomberg

But far more worrying is that despite a growth in gross bookings and net revenue, Uber is still losing money. In the last three months of 2016 alone, the company lost $991 million. Even though it sold its China-based business last year, it still had net global losses of $1.2 billion, which is far from ideal.

No one has ever questioned Uber's success in growing the company. But for the time being, the business model is not sustainable. Uber's propped up by a stack of investor cash (which some estimates put at around $7 billion); without the cash, which essentially subsidizes every Uber ride, it's unclear if the business model would work at all.

Compounding the issues are a recent wave of bad press, including allegations of sexual harassment, discrimination, and a video of Uber CEO Travis Kalanick arguing with a disgruntled employee.

With the bad news mostly hitting over the past few months, Uber's Q1 2017 earnings are going to be the key. A drop in bookings over the period would indicate that the #DeleteUber movement actually punished the company, and add another challenge to a company still trying to find profitability.