Apple Is Shutting Down Its Apple Pay Later Service - Good Riddance

Apple Pay Later has only been around for a little more than a year, but the company is already shutting down its Buy Now, Pay Later service. After announcing it at WWDC 2022, Apple launched the installment loan service in March 2023.

In a statement to 9to5Mac, the company confirmed that it is shutting down the Buy Now, Pay Later service immediately — the shutdown goes into effect today. So, if you go to buy something using Apple Pay, you'll no longer see the option to use Apple Pay Later.

Starting later this year, users across the globe will be able to access installment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay. With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the U.S. Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders.

Those who already have an Apple Pay Later loan that they are paying back will still be able to manage and pay their loan through the Wallet app. They just won't be able to start a new loan. Apple says that the reason it is shutting down the service is because it is releasing new features this fall in the Wallet app that will support installment loans from third-party credit and debit card providers.

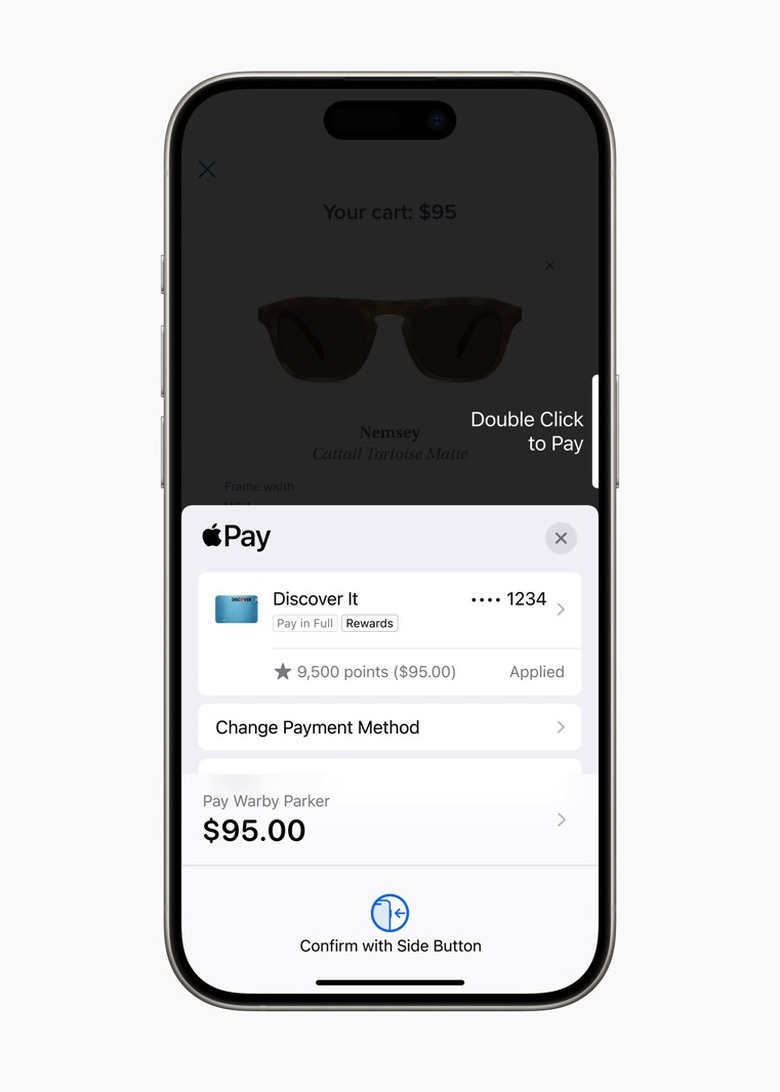

Apple Pay introduces even more flexibility and choice for users when they check out online and in-app. Users can view and redeem rewards, and access installment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad. These features will be available for any Apple Pay-enabled bank or issuer to integrate in supported markets.

Apple says it already has a number of partners lined up to offer installment loans through the Wallet app. The first countries to offer the feature will be Australia, Spain, the United Kingdom, and the United States. Apple is also partnering with Buy Now, Pay Later service Affirm in the U.S.

The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the U.S. with Discover and Synchrony, and across Apple Pay issuers with Fiserv. The ability to access installments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the U.K. with HSBC and Monzo; and in the U.S. with Citi, Synchrony, and issuers with Fiserv. Users in the U.S. will also be able to apply for loans directly through Affirm when they check out with Apple Pay.

I'm glad Apple is getting out of this business

I know Apple is trying to get deeper into the financial business, and I generally have thought that's a good thing. If there's one thing a lot of people could use more exposure to, it's financial education, and one of the company's reasons for getting into the credit card business with the Apple Card was to give people more insight into how such a product works with interest, rewards, and more.

The company offers Apple Pay, Apple Card, and most recently, Apple Savings, its own savings account that is still currently only available to Apple Card cardholders. I think the company has a real shot at making a really positive impact in the area of financial education and creating financial products that are much better than we've traditionally gotten from most banks. That's why I personally use all of them: Apple Card, Apple Savings, and Apple Pay.

However, I was never going to use Apple Pay Later. Buy Now, Pay Later services are there for one reason and one reason only: to make it easy for people who can't afford something to buy it anyway. Most of the time, people use Buy Now, Pay Later services like Affirm and Klarna to buy things that they don't actually need but want. It's the credit card of the 21st century and it is especially praying on younger people.

Roping people into loans through a payment fad certainly never felt that it aligned with what Apple is trying to accomplish with its moves into the financial industry, and I'm glad to see the company step away from being directly in this business. If it wants to give other companies the ability to offer those services through its platform, that's fine, but don't get in such a grimy business yourself.

Use those resources for the Apple Checking account instead. That's what I'm waiting for.