Facebook Just Announced Its Bitcoin Rival, But Is It Really Safe And Secure?

Just as expected, Facebook on Tuesday announced its Bitcoin rival called Libra, a cryptocurrency created by a Facebook subsidiary called Calibra that will be managed by an oversight body called the Libra Association. The Libra coin will not be available immediately, as the announcement only covers the vision and technology behind the Facebook blockchain. But the company says Libra will be private, mostly.

The privacy

We've already explained that Facebook has to gain our trust before we can trust Libra, and it looks like the company is taking the proper steps in that direction. And from the get-go, we'll note the first issue with Calibra: just head over to Calibra.com, wait for the cookies notification to pop-up, and try to click the Learn more link, see if it gets you anywhere. At the time of this writing, when Facebook unveiled the Libra product, the link is dead.

In its announcement, Facebook says that it won't use any Calibra data to improve the performance of Facebook ads, which should definitely be on your list of Libra-related worries (emphasis ours):

We'll also take steps to protect your privacy. Aside from limited cases, Calibra will not share account information or financial data with Facebook or any third party without customer consent. This means Calibra customers' account information and financial data will not be used to improve ad targeting on the Facebook family of products. The limited cases where this data may be shared reflect our need to keep people safe, comply with the law and provide basic functionality to the people who use Calibra. Calibra will use Facebook data to comply with the law, secure customers' accounts, mitigate risk and prevent criminal activity.

However, Calibra and Facebook may use your data, or share data between your Libra and Facebook accounts, although the Customer Commitment document explains your consent would be solicited beforehand (emphasis ours):

Calibra will use Facebook, Inc. data to comply with the law, secure customers' accounts, mitigate risk, and prevent criminal activity. Beyond these cases, if a Calibra product feature can be personalized or improved with data from Facebook, we will first obtain customers' consent to share the relevant data with Calibra.

You might not have a say in everything Calibra can use about you, however:

Calibra will use customer data to facilitate and improve the Calibra product experience, market Calibra products and services, comply with legal and regulatory obligations, and ensure safety, security, and integrity. We may also use customer data to conduct research projects related to financial inclusion and economic opportunity with, for example, academic institutions and NGOs, though any published results will only contain aggregated statistics.

Calibra will be transparent by offering customers choice and control using clear, simple language and easy-to-find privacy controls that detail what data is collected, used, and shared, and for what purposes.

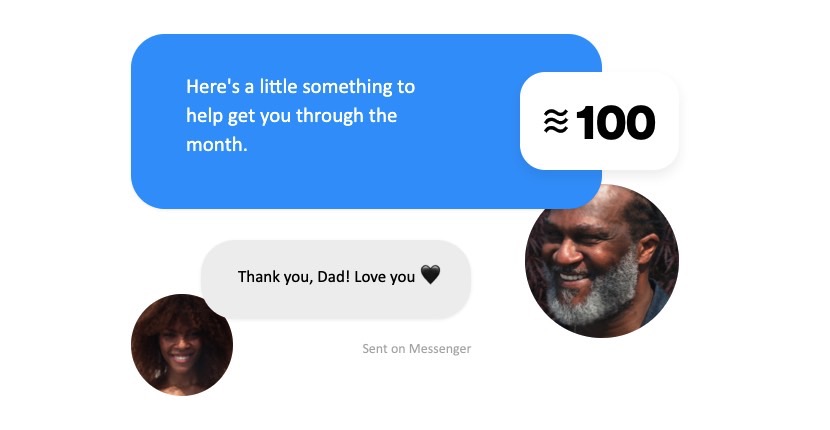

Also, we'll note that Facebook might still be able to collect Libra collection data from Facebook Messenger use as long as Messenger is not end-to-end encrypted as WhatsApp is. Hopefully, Messenger will get end-to-end encryption, the kind Facebook already promised before Libra launches.

How it works

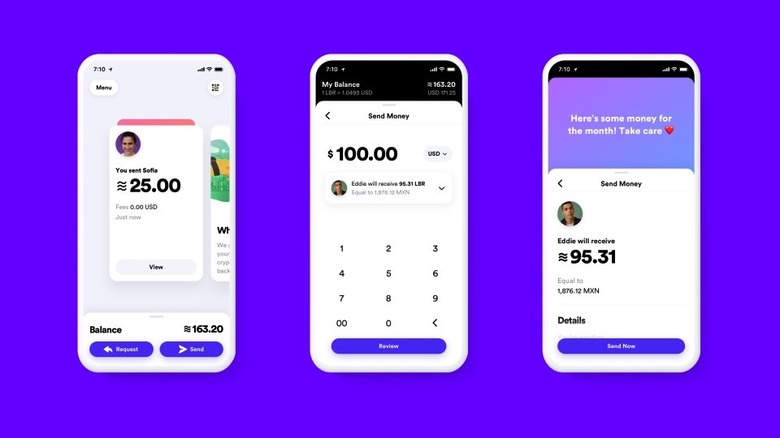

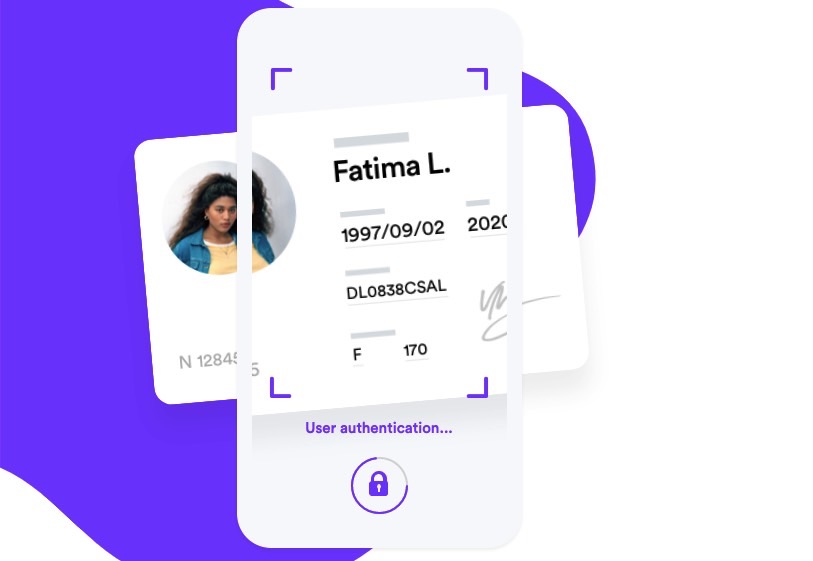

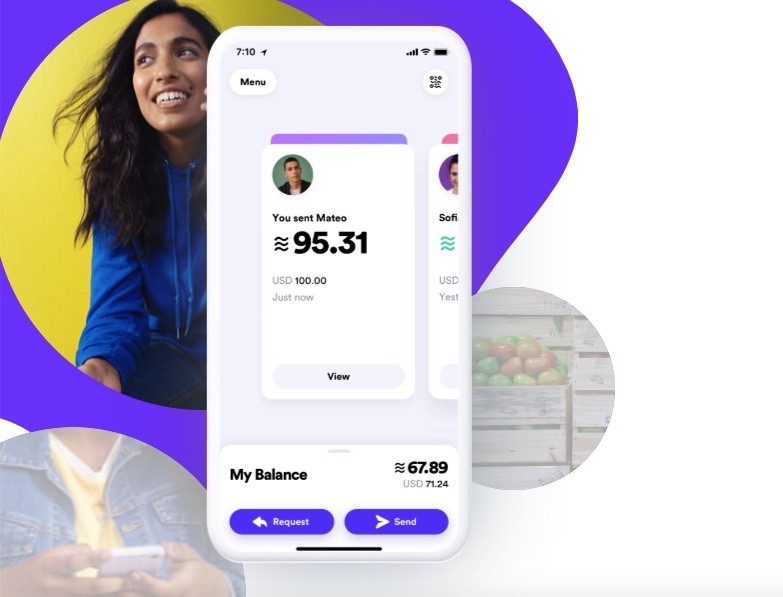

As expected, you'll have to verify your identity before being able to convert fiat currency into Libra and send that money to friends and family or pay for other products. But while Libra has been conceived to be used within Facebook Messenger and WhatsApp, you'll also be able to create standalone accounts not related to your Facebook profile. Calibra will have wallets for both iPhone and Android next year, and Libra will be available on crypto exchanges — Coinbase is one of the initial node/partners of Facebook.

When it comes to anonymity, the white paper says the blockchain is pseudonymous, allowing you to create addresses that aren't linked to your real-life identity (emphasis ours):

The Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity. This approach is familiar to many users, developers, and regulators. The Libra Association will oversee the evolution of the Libra Blockchain protocol and network, and it will continue to evaluate new techniques that enhance privacy in the blockchain while considering concerns of practicality, scalability, and regulatory impact.

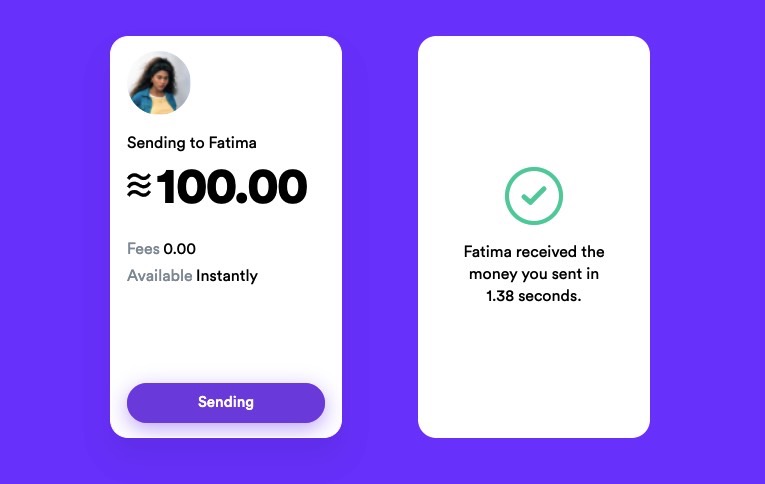

Once you have an account, transfers should be immediate, as it'll take only a few seconds for your money to move across borders.

How Facebook makes money

Libra will have a stable value, but it won't be pegged to the Dollar, Euro, Yen, or any other fiat currency, and that's because Facebook is doing things differently.

As explained in the Libra white paper, or over on the Calibra site, Libra will be backed by assets around the world. That means the value of one Libra may fluctuate related to your local currency:

It is important to highlight that this means one Libra will not always be able to convert into the same amount of a given local currency (i.e., Libra is not a "peg" to a single currency). Rather, as the value of the underlying assets moves, the value of one Libra in any local currency may fluctuate. However, the reserve assets are being chosen to minimize volatility, so holders of Libra can trust the currency's ability to preserve value over time. The assets in the Libra Reserve will be held by a geographically distributed network of custodians with investment-grade credit rating to provide both security and decentralization of the assets.

Moreover, Facebook explains there will not be inflation, and Libra coins will be created and destroyed depending on the market. The more users exchange fiat for Libra, the more Libra coins will be made. In turn, Libra coins will be burned as they're turned back into fiat.

Facebook and its partners will make money from interest accrued from the Libra Reserve, which means you'll get very low commissions for those almost instant transactions:

Users of Libra do not receive a return from the reserve. The reserve will be invested in low-risk assets that will yield interest over time. The revenue from this interest will first go to support the operating expenses of the association — to fund investments in the growth and development of the ecosystem, grants to nonprofit and multilateral organizations, engineering research, etc. Once that is covered, part of the remaining returns will go to pay dividends to early investors in the Libra Investment Token for their initial contributions. Because the assets in the reserve are low risk and low yield, returns for early investors will only materialize if the network is successful and the reserve grows substantially in size.

The list of partners includes several companies from a variety of fields, including Facebook, Calibra, Visa, MasterCard, PayPal, eBay, Lyft, Uber, Vodafone, Iliad, Spotify, Andreessen Horowitz, Coinbase, and others.