Earlier today we posted a smartly argued piece of analysis from Wedge Partners analyst Brian Blair, who made a compelling case that BlackBerry should get out of the high-end smartphone market completely and move aggressively to target emerging markets with bargain-bin smartphones. While Blair made a lot of terrific points in his analysis, I found myself at the end unpersuaded that his advice to BlackBerry is the best course of action for the company to take.

Here, in my non-expert opinion, are the biggest problems BlackBerry would face if it moved exclusively to the low-end market:

- First, no matter how cheap BlackBerry makes its devices, there will always be a no-name vendor willing to go even cheaper. For example, consider the Xiaomi Hongmi, an Android smartphone that released in China this year that features a quad-core 1.5GHz processor, a 4.7-inch display with a pixel density of 312 pixels-per-inch, an 8-megapixel rear-facing camera and a 2,000 mAh battery… and that costs only $130 off-contract. You can be certain that Xiaomi is barely making any profit on every device it sells and is only able to stay in business by pumping out tons of these phones and aggressively selling them to consumers in emerging markets. And there are many, many more Xiaomis in emerging markets than BlackBerry could ever hope to keep up with.

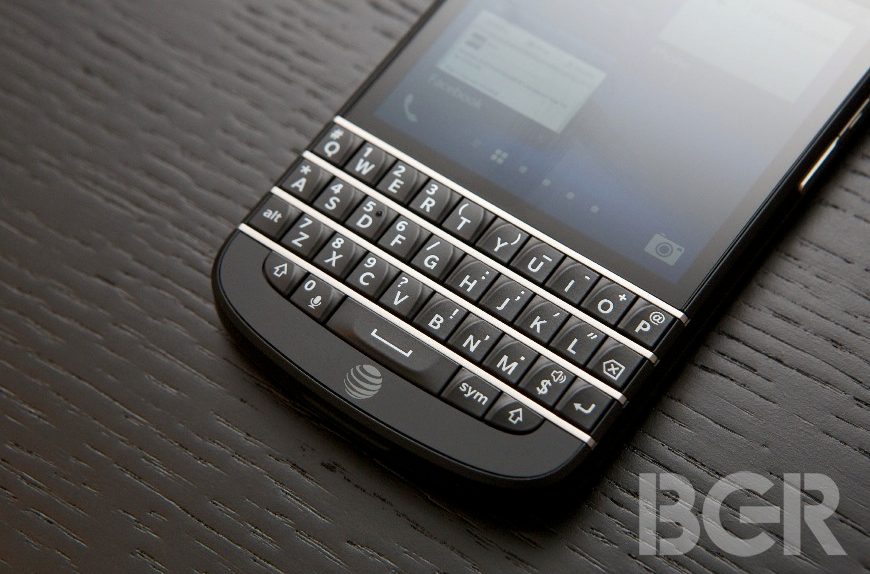

- Second, I’m unpersuaded that BlackBerry could make its keyboards that big of a differentiator to drive demand away from dirt-cheap Android phones. Yes, there are some diehards who still only want a phone with a full QWERTY keyboard but they are small in numbers and remind me of the people who used to argue that Betamax was obviously superior to VHS — whatever the merits of their case, it’s pretty clear that they’ve lost. The ship on keyboard smartphones sailed years ago and if there were still money to be made from mass-producing them you can bet that Samsung would be spamming out QWERTY-equipped editions of the Galaxy S4.

- Finally, I find myself unconvinced by Blair’s suggestion that BlackBerry can make up its app gap with iOS and Android by only offering “the very best and most popular applications” and paying off the top developers to bring their apps to BlackBerry 10. The reason this makes little sense is simple: The app market is one of the most notoriously unpredictable markets that I’ve ever seen. There is no way to know when the next big app will blow up — after all, how many people were talking about Snapchat two years ago? And now it’s one of the apps that no serious mobile platform can do without. If you’re always paying off big-name developers to bring their apps to your platform then that means you’re always one step behind your competition. And given that there’s no way to know whether today’s hot app will still be hot in 6 months — anyone remember Draw Something? — then devoting significant resources to bribing app developers is a very risky proposition.

So what should BlackBerry do if it can’t chase the low-end market? As I said, I’m not an expert but I think the company’s best shot at a turnaround is probably to go back to its roots as an enterprise mobile software company and forget about chasing the consumer market all together.

The multiple scandals surrounding the NSA shows that there’s still a significant need for secure mobile communications and we’ve read several reports suggesting that BlackBerry has been the one big tech company whose products the NSA has been unable to crack. If BlackBerry can pitch itself to NSA-wary companies and governments as the only surefire way to keep your communications secure then I think it could regain some of the traction it’s lost in the enterprise.

What would such a company look like? Well it would be focussed primarily around cross-platform mobile device management and its hugely popular BBM messaging software. As far as smartphones go, the company would have to drastically cut down on the number of devices it makes and would basically only sell its own hardware as high-end items for CEOs and government officials who require the utmost security. This would mean giving up on making BlackBerry a be-all smartphone for mass consumers and would make it device used primarily for secure communications — which, if you recall, is how the BlackBerry first became a status symbol in the first place.

I honestly have no idea whether such a plan would really work or if the economics are even there to make it work in the first place. But doing secure mobile communications well is what’s in BlackBerry’s very basic DNA; trying to chase down scraps of cash by selling low-end smartphones is certainly not.